Statutory Income From Employment Malaysia

A during which the employment is exercised in malaysia.

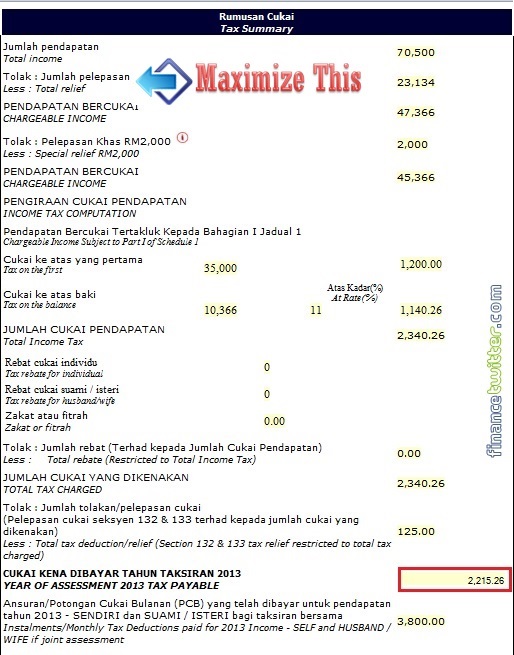

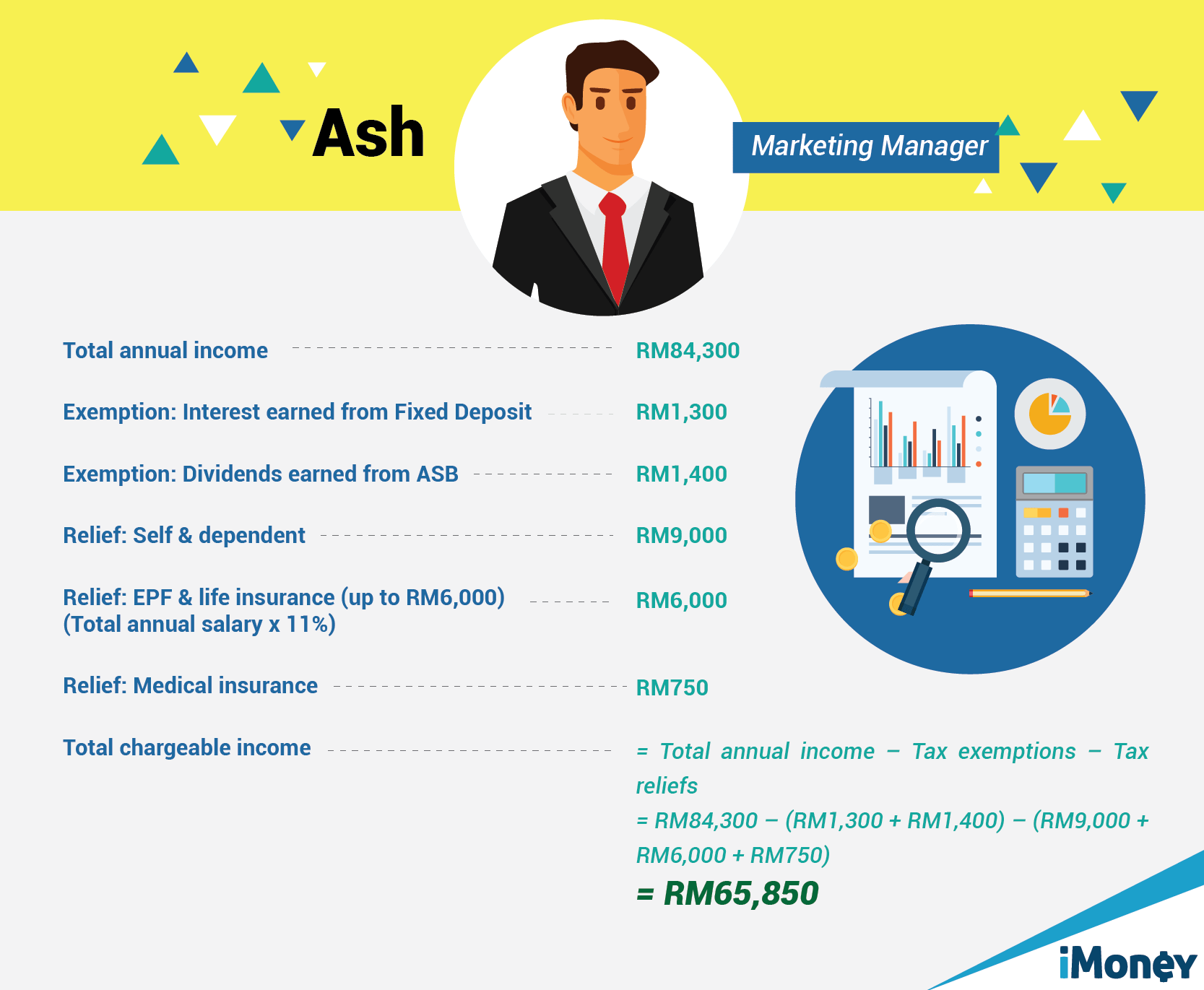

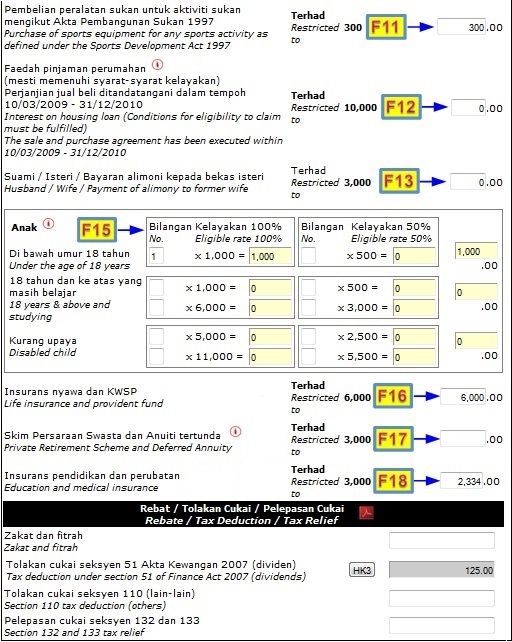

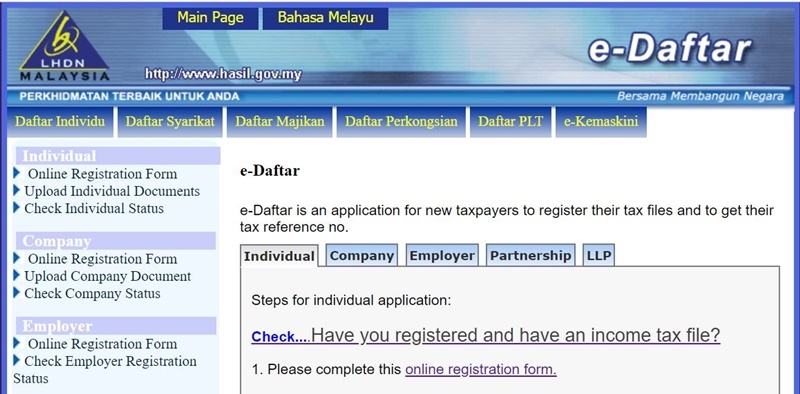

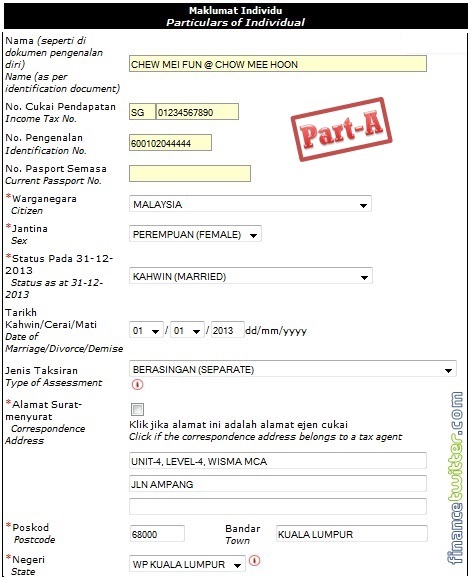

Statutory income from employment malaysia. These include personal income tax pcb epf socso eis hrdf or others. Under statutory income fill out all the money you earn from employment rents and other sources in the respective boxes. A monthly wages rm 5 000 and below minimum of 6 5 of the employees monthly wages. Since 2016 lembaga hasil dalam negeri lhdn has decided that anyone who earns an annual employment income of rm25 501 after epf deduction has to register a tax file.

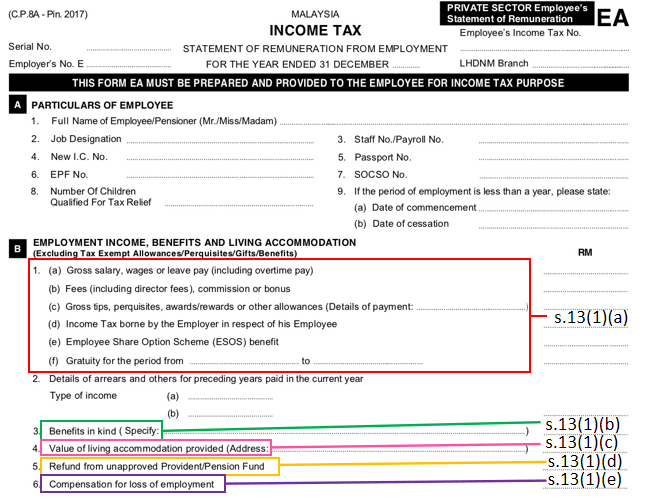

An easy way to know whether you need to pay up is to take a look at the ea form your hr department would give you. As a hassle free solution hr my provides automated calculation of all employer and employee portions of the respective statutory contributions according to the rates specified in employee management edit salary statutory details. A employees who are not malaysian citizens but are permanent residents in malaysia and. In malaysia mandatory payroll benefits include paid annual leave statutory holidays maternity or medical leave and benefits for termination or unemployment.

Gross employment income what are the types of income which are taxable and subject to monthly tax deduction mtd or in bahasa malaysia potongan cukai berjadual pcb. For computing the statutory income from employment. Click here to find out what income is taxable.

This is where your ea form comes into play as it states your annual income earned from your employer. Payroll processing in malaysia normally takes place on a monthly basis. Types of income under section 13 1 of the act states that the gross income of an employee concerning gains or profit from an employment includes. Every employer and employee are responsible to pay respective statutory contributions using a portion of their wages.

Employment law malaysian employment law statutory contributions in malaysia employment act 1955 employees provident fund act 1991 employees social security act 1969 employment insurance system act 2017 income tax act 1967 employees provident fund epf social security organization socso employee insurance system eis scheme schedular tax deduction pcb ptptn. The form will automatically calculate your aggregate income for you. B leave is attributable to the exercise of the employment in malaysia. Minimum of 5 5 of the employees monthly wages.

Under subsection 13 2 of the ita income from an employment is deemed derived from malaysia if the income arises for any period. Third schedule part c of the epf act 1991 shall apply to the following employees. Agreement with malaysia and claim for section 132 tax relief hk 9 income from countries without avoidance of double taxation 30.