Statutory Income Definition Malaysia

Total income 44 a.

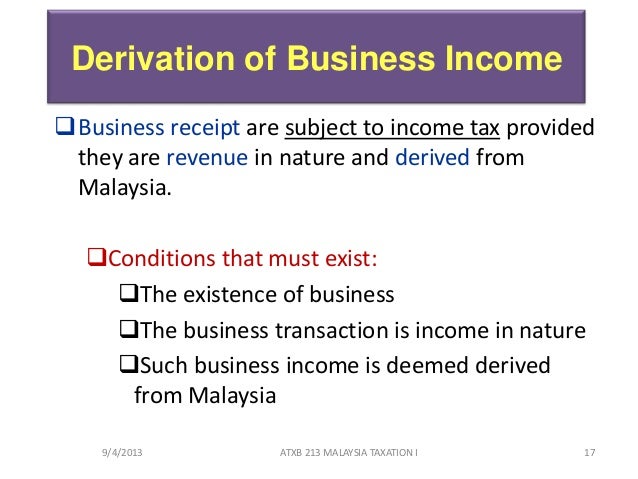

Statutory income definition malaysia. And b the amount of i any balancing charge or the aggregate amount of the balancing charges. Carry back losses chapter 7 chargeable income 45. 6 laws of malaysia a ct 53 chapter 5 statutory income section 42. 6 laws of malaysia a ct 53 chapter 5 statutory income section 42.

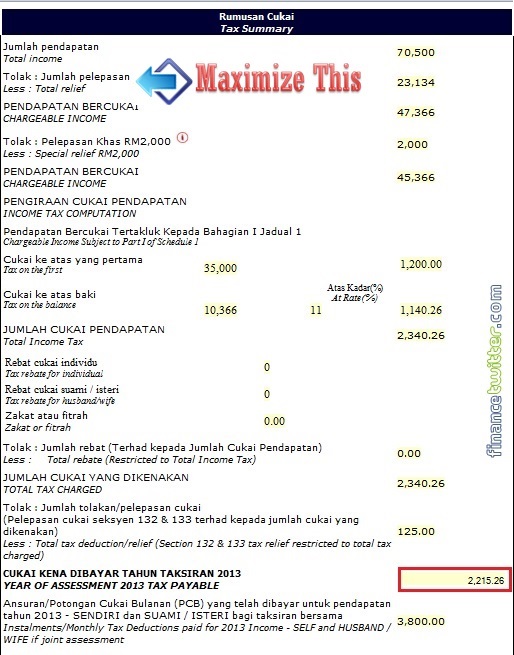

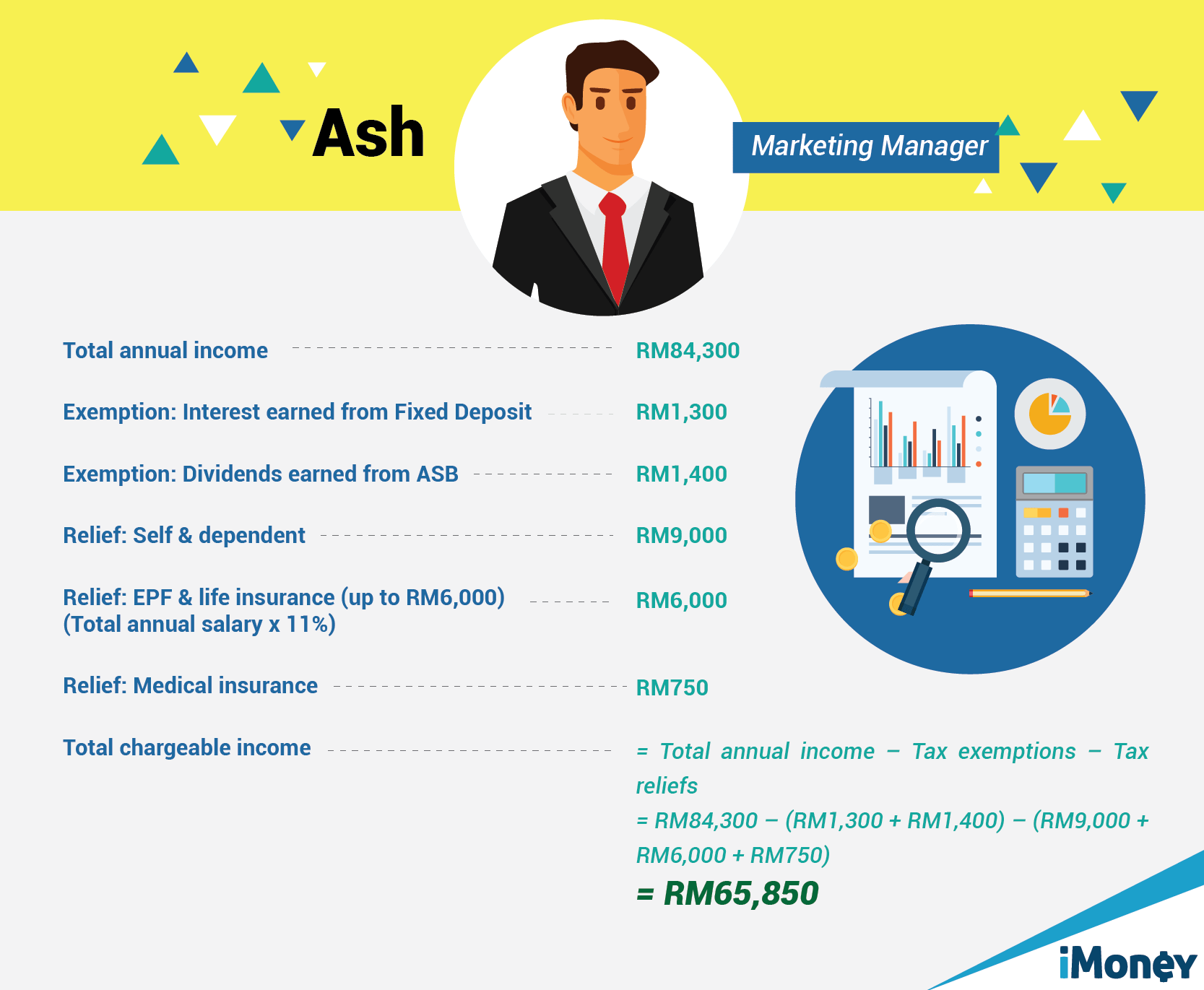

Klik sini untuk versi bm. Unrestricted employment of local and foreign knowledge workers. When it comes to the season of income tax in malaysia that s when people tend to leave things till the last minute are you one of them and then make careless mistakes out of panic. The flowchart format of computation of total income in relation to an individual is as in appendix a.

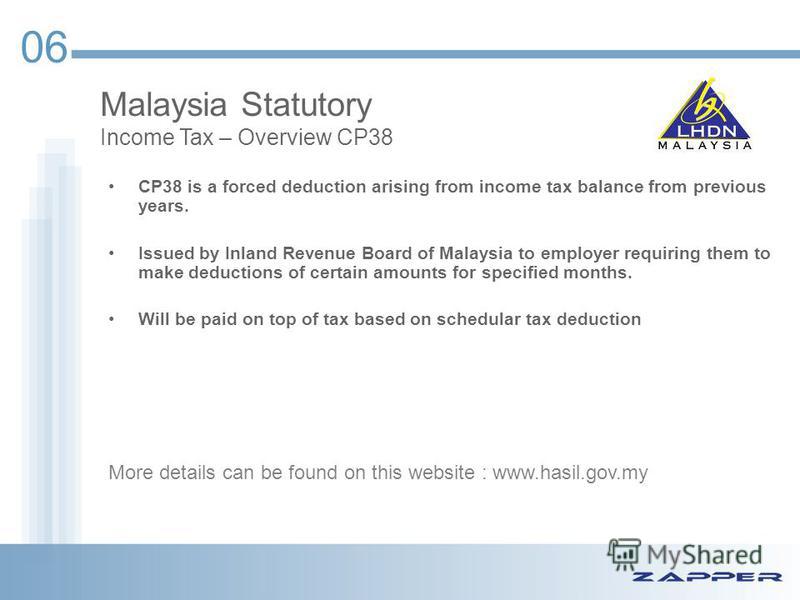

Income tax exemption for five years and extendable by five years on statutory income or value added income derived from services provided in relation to core income generating activities for msc malaysia. Intellectual property income as defined is excluded from the incentive. Group relief for companies 44 b. Employment law malaysian employment law statutory contributions in malaysia employment act 1955 employees provident fund act 1991 employees social security act 1969 employment insurance system act 2017 income tax act 1967 employees provident fund epf social security organization socso employee insurance system eis scheme schedular tax deduction pcb ptptn.

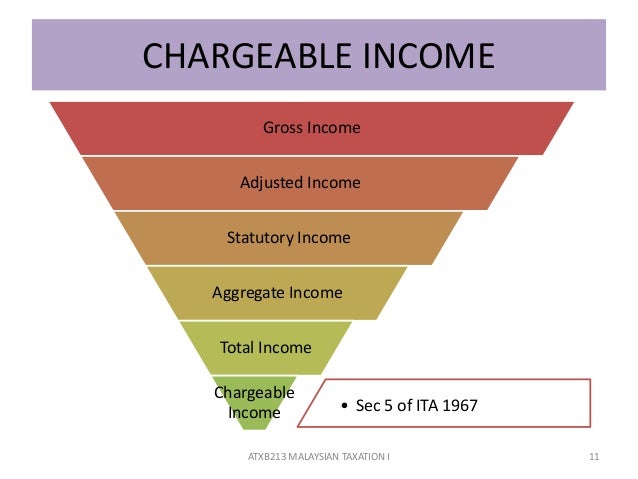

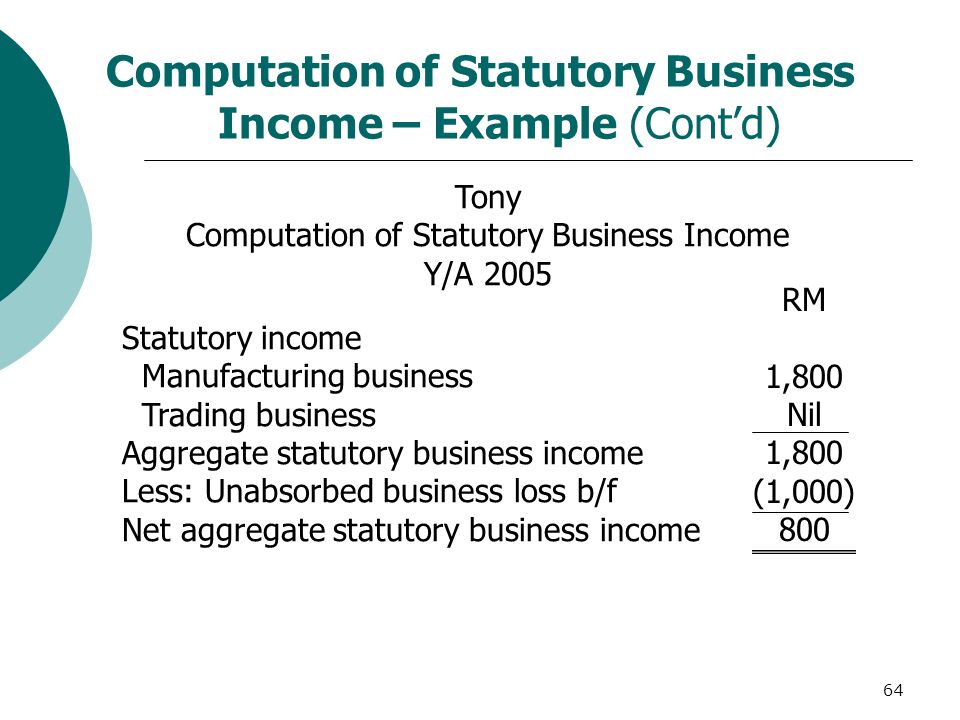

Statutory income chapter 6 aggregate income and total income 43. Gross income gross income is the summation of basic salary variable pay bonus deduction. Carry back losses chapter 7 chargeable income 45. This means that hr my will calculate the portion based on the percentage decided by you during payroll run.

As explained earlier not all salary components are necessarily involved in all statutory contribution calculation. There s also an exemption of 50 on the statutory income of rental received by malaysian citizens who live in malaysia. Statutory income is also reffered to as take home pay as it is the amount of money you take home after all deductions. Total income 4 2 the chargeable income stage and the manner in which income tax is computed for an individual will be discussed in another separate public ruling.

Statutory income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the income tax act. Statutory income chapter 6 aggregate income and total income 43. Group relief for companies 44 b.