Standard Chartered Personal Loan

For 58 years retirement proof to be in place the minimum monthly income of the applicant should be inr 25 000 in case of.

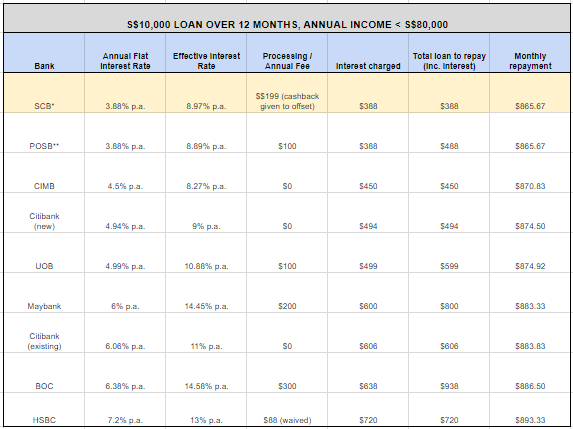

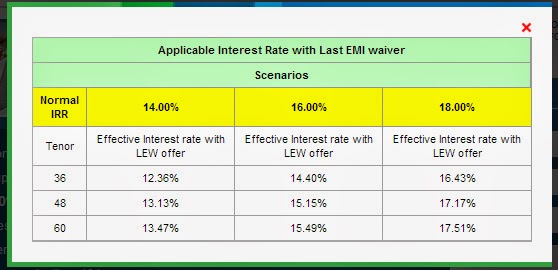

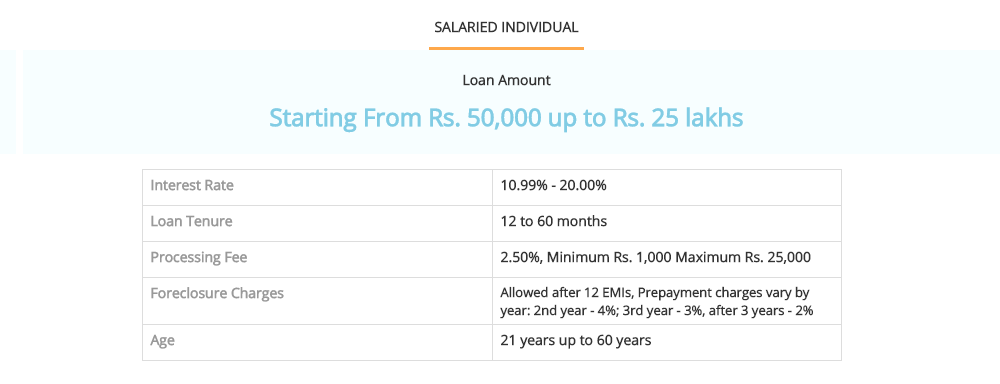

Standard chartered personal loan. The standard chartered bank provides a repayment tenure between 12 60 months. Depending on the loan amount you borrow the interest rates vary from 12 to 17. You can borrow up to kshs 7 million. The repayment period is flexible as it is between 6 72 months.

Enjoy lifetime annual fee waiver on your standard chartered visa platinum credit card with cashone. With standard chartered bank you can avail personal loans ranging from inr 1 lakh to inr 50 lakhs depending on your income. An unsecured loan for standard chartered bank customers who receive their salary through the bank. How is personal loan interest rate calculated.

Next day cash terms and conditions standard chartered bank singapore limited the bank s next day cash is a service whereby if an applicant successfully submits a completed application to the bank for a personal loan by 2pm monday friday excluding public holiday and the bank approves such an application the bank will disburse the funds on the next working banking day monday friday excluding public holiday. Standard chartered bank offers personal loans ranging from inr 1 lakhs to inr 30 lakhs. You get a discount on the processing fees if you apply online for a personal loan. Only existing to bank customers are eligible for extended tenures of up to 84 months.

New to bank customers may apply for tenures of up to 60 months. Eligibility criteria for standard chartered personal loan the minimum age of the applicant should be 21 years the maximum age of salaried should be 65 years respectively.