Standard Chartered Bank Personal Loan

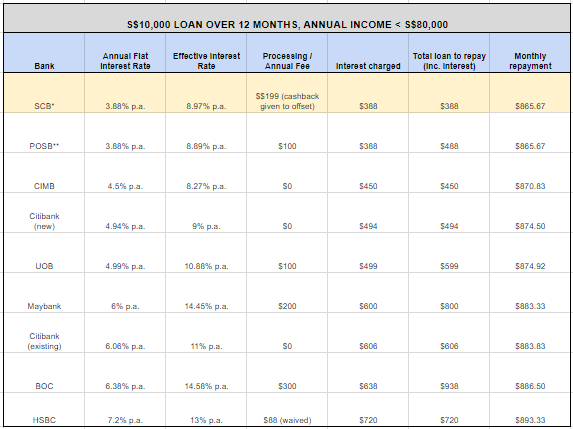

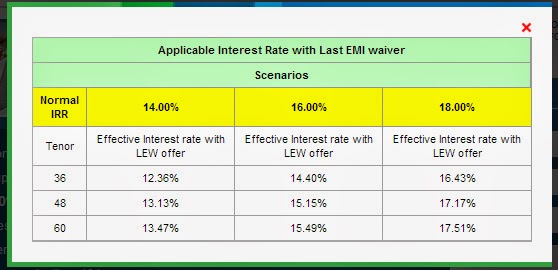

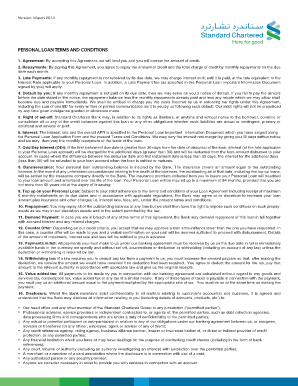

The interest rates offered on standard chartered personal loans start from just 12 and the processing fee applicable to the loan is just 1 of the amount borrowed.

Standard chartered bank personal loan. Standard chartered bank provides personal loan statement on your e mail id every month. Depending on the loan amount you borrow the interest rates vary from 12 to 17. Here are some unique benefits of availing a loan with standard chartered bank. Eligibility criteria for standard chartered personal loan.

Applicant must indian citizen. Enjoy financial flexibility with standard chartered cashone a personal loan that works together with your card limit apply now a personal loan that works harder for you. The best thing about this statement is that you can anytime access the same and keep an eye on your personal loan account on the go. Tailored specifically to meet your needs at a low interest rate.

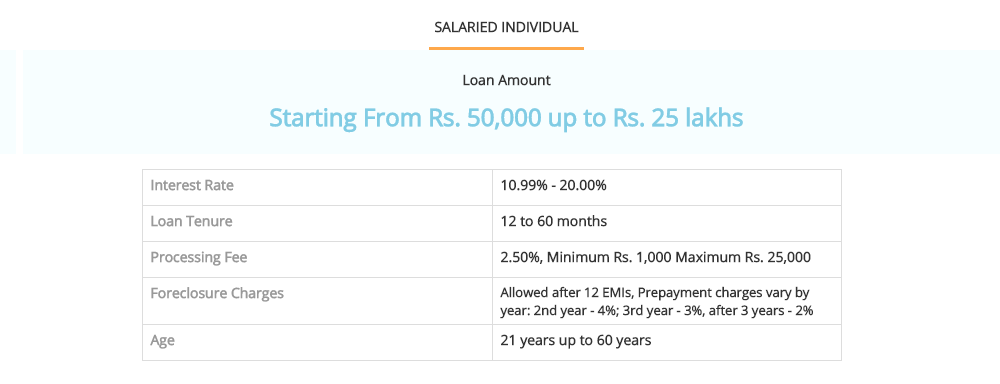

With standard chartered bank you can avail personal loans ranging from inr 1 lakh to inr 50 lakhs depending on your income. Applicant must be gainfully employed for more than 12 months. The standard chartered bank provides a repayment tenure between 12 60 months. Applicant must be above the age of 23 years.

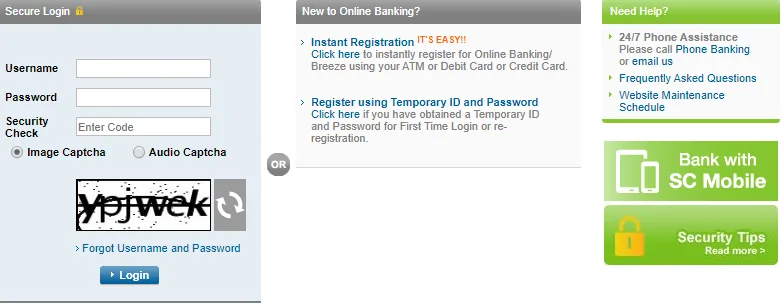

Personal loans are provided up to the age of 58 years. How is personal loan interest rate calculated. The statement includes all the details such as account number loan details personal credentials etc. You get a discount on the processing fees if you apply online for a personal loan.