Standard Chartered Balance Transfer

Transfer card balance up to inr 5 lakh.

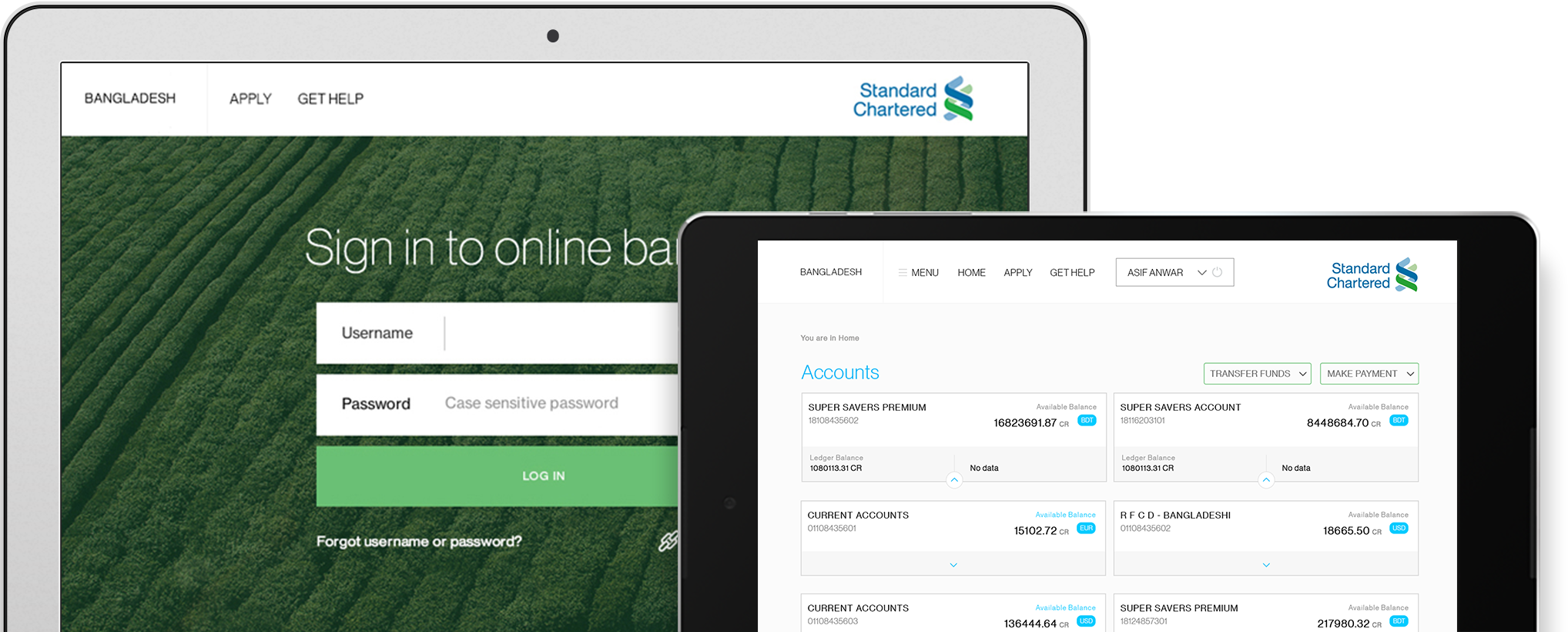

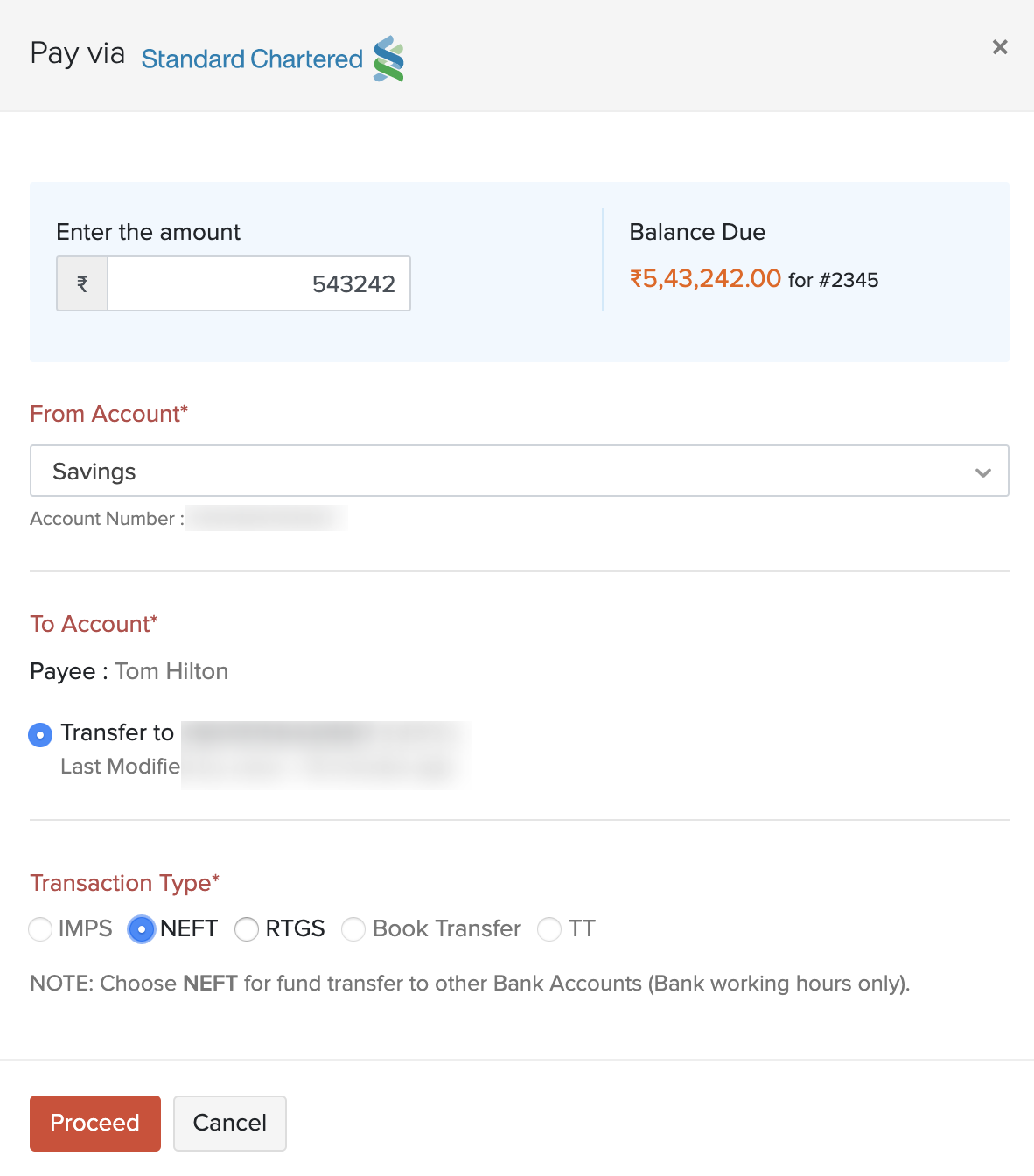

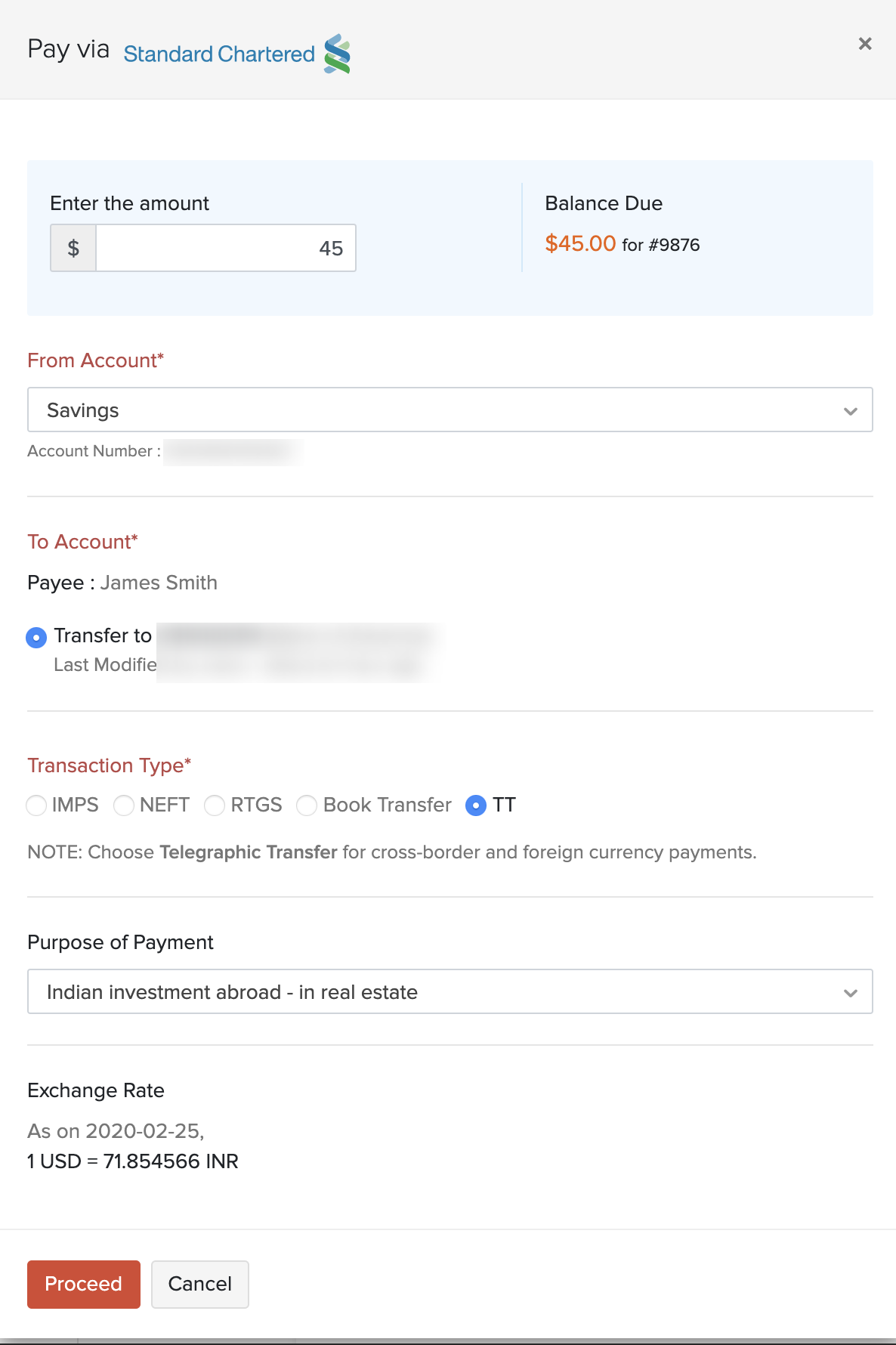

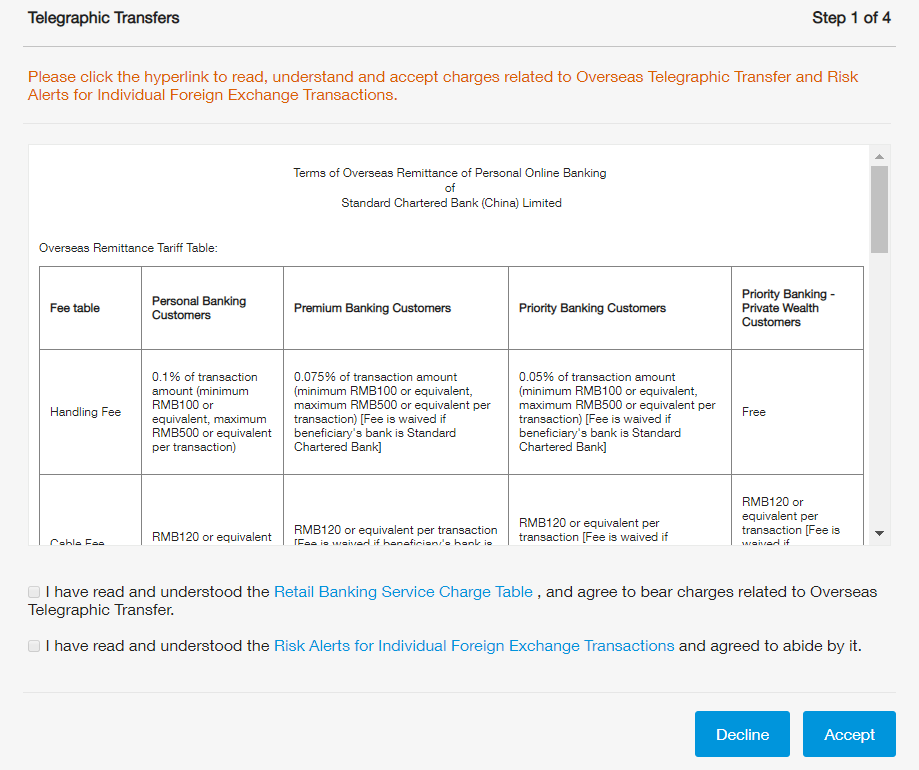

Standard chartered balance transfer. Pay just 5 of the outstanding balance each month. The transfer of funds to the applicant s designated standard chartered current cheque save account s or non standard chartered current or savings account or non standard chartered credit card account each account a designated account and each such transfer of funds a funds disbursement is subject to a the applicant successfully submitting a completed application to the bank. By participating in this campaign participants agree to be bound by all the terms and conditions below. It offers interest free funds transfer with a one time processing fee of either 1 99 6 month tenure or 4 5 12 month tenure which will be charged on the first month.

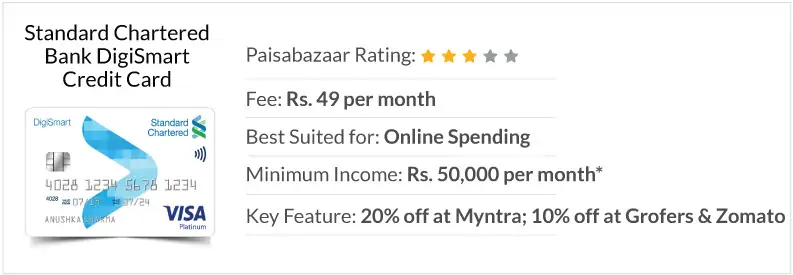

Interest rate of just 0 99 per month for the first 6 months. The monthly repayment for a balance transfer plus amount of rm1 000 with a tenure of 36 months and an interest rate of 5 99 p a. Balance transfers tend to have short loan tenures of up to 12 months. If you are keen in applying for a credit card funds transfer the standard chartered credit card funds transfer is an option you can consider.

This processing fee is usually paid upfront. Rm1 000 rm1000 x 5 99 x 3 years 36 months. No early termination fee. And b the bank approving the application which must satisfy the bank s eligibility criteria.

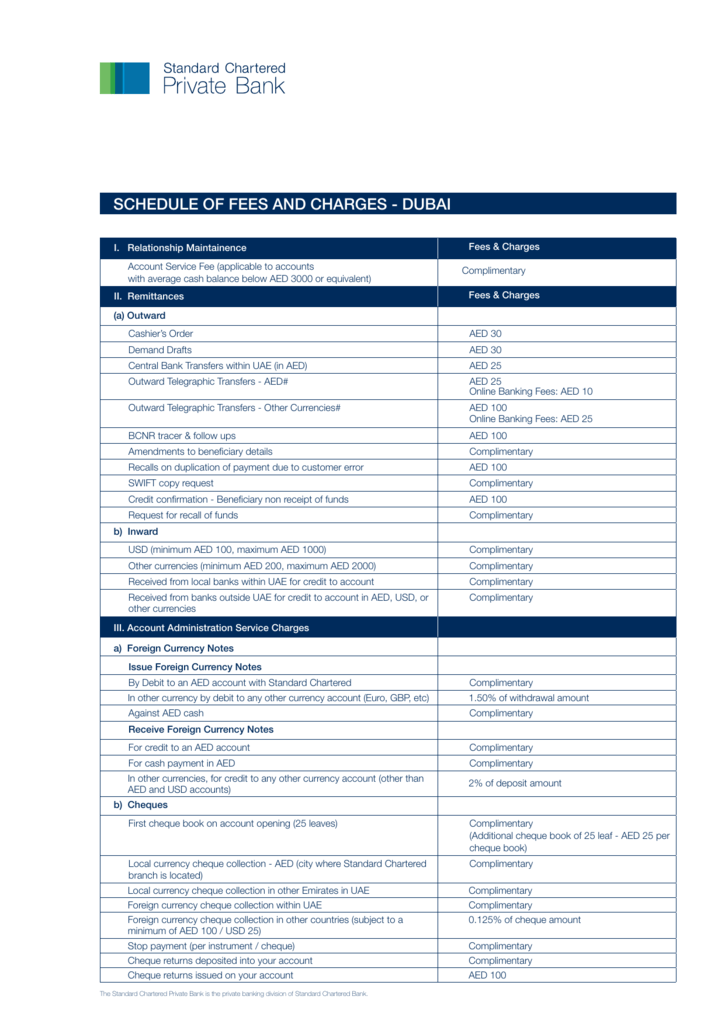

This is helpful for people who are facing difficulty in repayment of their credit card debt. Standard chartered balance transfer plus transfer your outstanding balance to a new standard chartered credit card with low interest rates. They can transfer their balance to scb credit card and save on the overall interests. Door delivery of the draft in just 7 days.

The standard chartered bank malaysia berhad scbmbor the bank balance transfer plus 0 campaign campaign commences on 10 february and ends on 31 march 2020 inclusive of both dates campaign period. Your normal credit card interest rate is applicable after 6 months. Tenure of 3 6 9 or 12 months. Transfer your outstanding credit card balance from other banks to a standard chartered bank credit card.

With most balance transfers offering 0 interest rate you can select a balance transfer based on these 2 main factors. Up to 36 months. Stretch your repayments for as long as you can. Interest rate from 5 99 p a.

The interest rate charged by standard chartered on a balance transfer is 0 99 per month for the first six months of the repayment tenure. Just choose a period you would like to extend your repayment to for up to 36 months and a minimum transfer amount of rm1 000. Standard chartered bank credit card balance transfer is the transfer of outstanding balances from other bank s credit card into scb credit card. Customers can make balance transfers to up to rs 5 00 000 onto a standard chartered credit card from other credit cards.