Stamp Duty For Property Registration In Noida

As such these charges can run into lakhs of rupees.

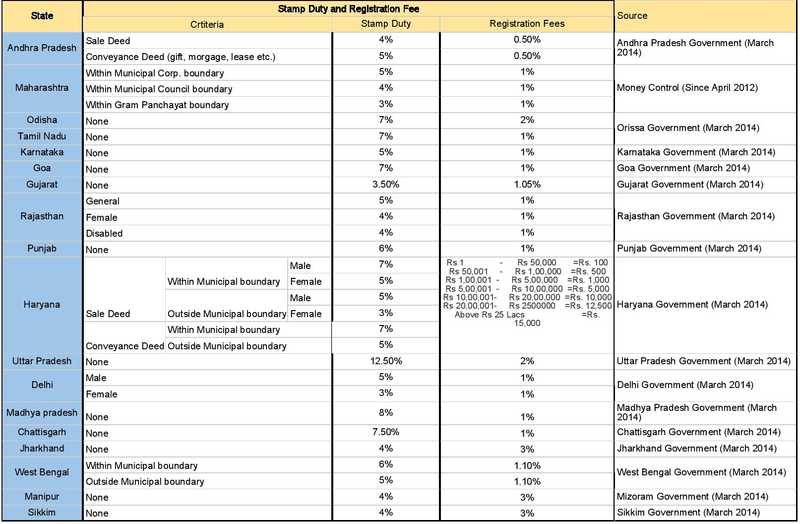

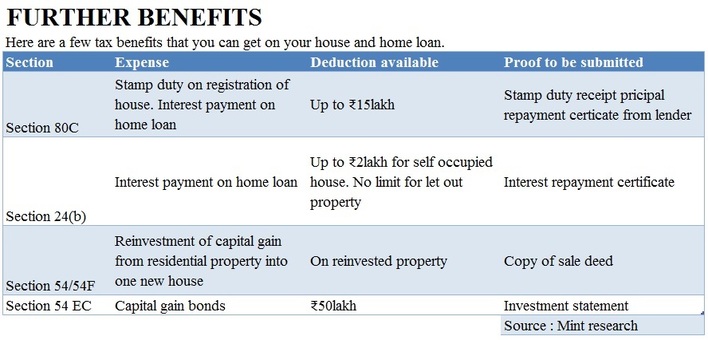

Stamp duty for property registration in noida. After submitting the required documents the documents would be verified and the actual fee payment challan and completing e kyc the sub registrar registers the documents. It is important to know the current stamp duty rates and house registration charges in noida. The cost of stamp duty is generally 5 7 of the property s market value. Right now the stamp duty rates in noida are charged at seven percent.

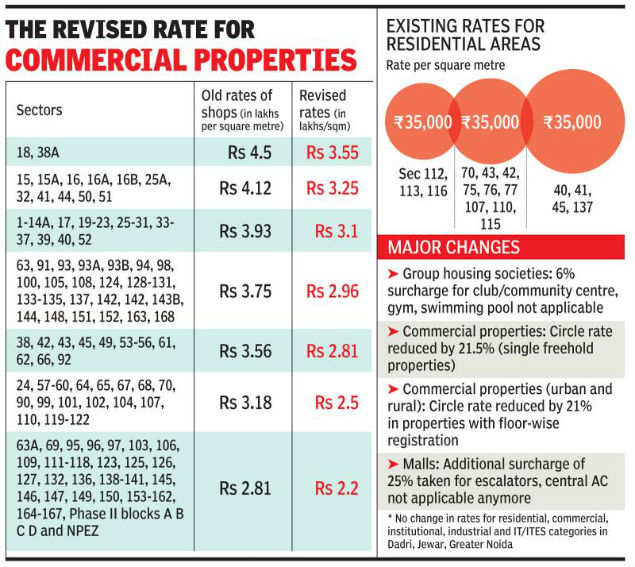

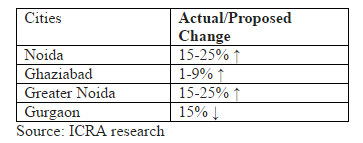

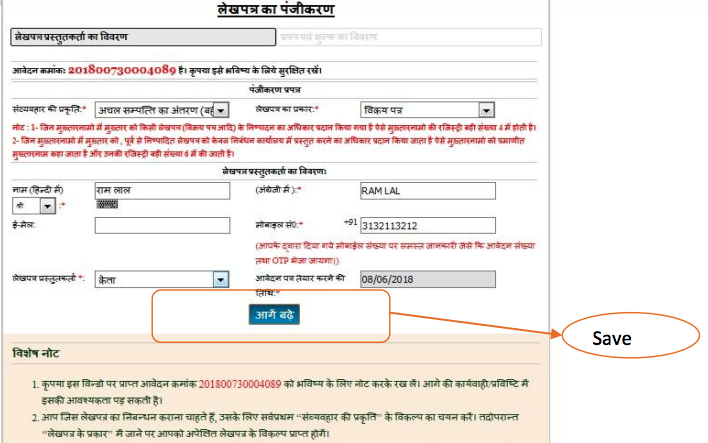

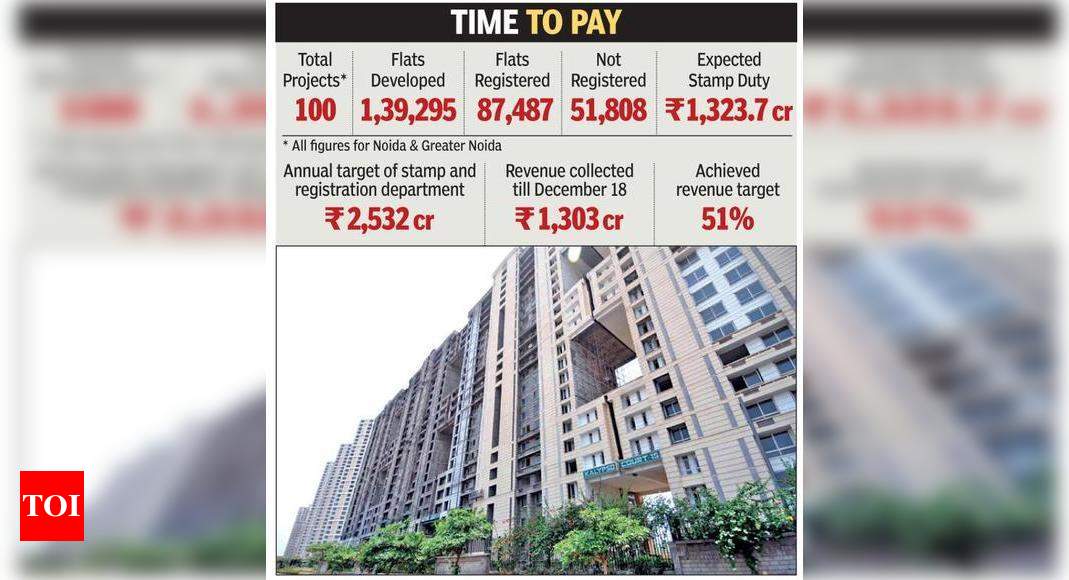

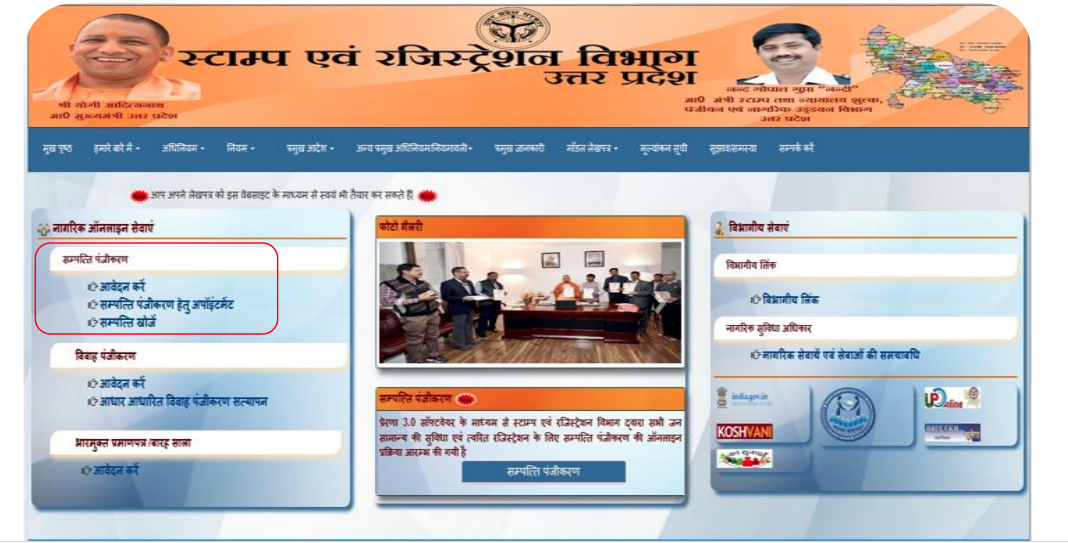

The cost of owning a property will come down in noida and greater noida as the district magistrate has proposed a steep rebate in circle rates which will reduce registration cost of commercial institutional and residential properties by up to 50 per cent in these areas the times of india reported. Under the new rules stamp duty on registration fees will be calculated as one percent of such consideration or value calculated for the purpose of stamp duty chargeable on the document whichever is higher subject to the minimum of rs 100. The software will auto calculate the applicable stamp duties and registration fees. Now you need to opt for property valuation in which you need to select the type of building type of property details of the independent building by filing the residential area and total area.

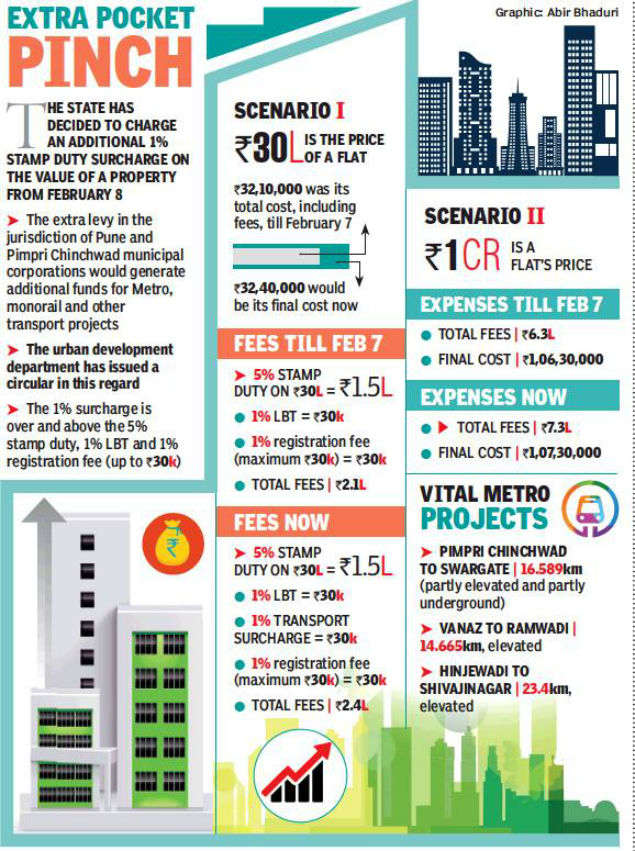

To avoid any shortfall in funds when buying your home and registering the property in your name ensure that you also requisition for the stamp duty and registration charges when you apply for the home loan amount. In the notification the new stamp duty rates have been stipulated with the assent of the governor. The uttar pradesh government demands stamp duty and registration fees at the time of registration of the property. Yogi adityanath government in up notified the new stamp duty rates doing away with rs 20 000 maximum cap on property registration.

Current stamp duty rates in noida. Registration charges tend to be 1 of the property s market value. Fill the details of the parties and their roles such as buyer and. The registration charges for the resale of residential properties in hyderabad would be stamp duty is 4 transfer duty is 0 5 and the registration fee is 0 5 of the market value of the property.

Registry charges in noida registration charges are an additional levy over and above the stamp duty and are levied to cover the cost of running registration offices by the government while registering property in noida you will need to pay a registration fee of rs. Do not forget tr ansfer memo an equivalent am ount is charged for any transf ers in noida authority. New rule on stamp duty in uttar pradesh will have an impact on realty as stamp duty will go up now including in big metros like lucknow ghaziabad and noida too.