Stamp Duty Exemption Malaysia 2016

That will be up to a maximum stamp duty exemption of rm5000.

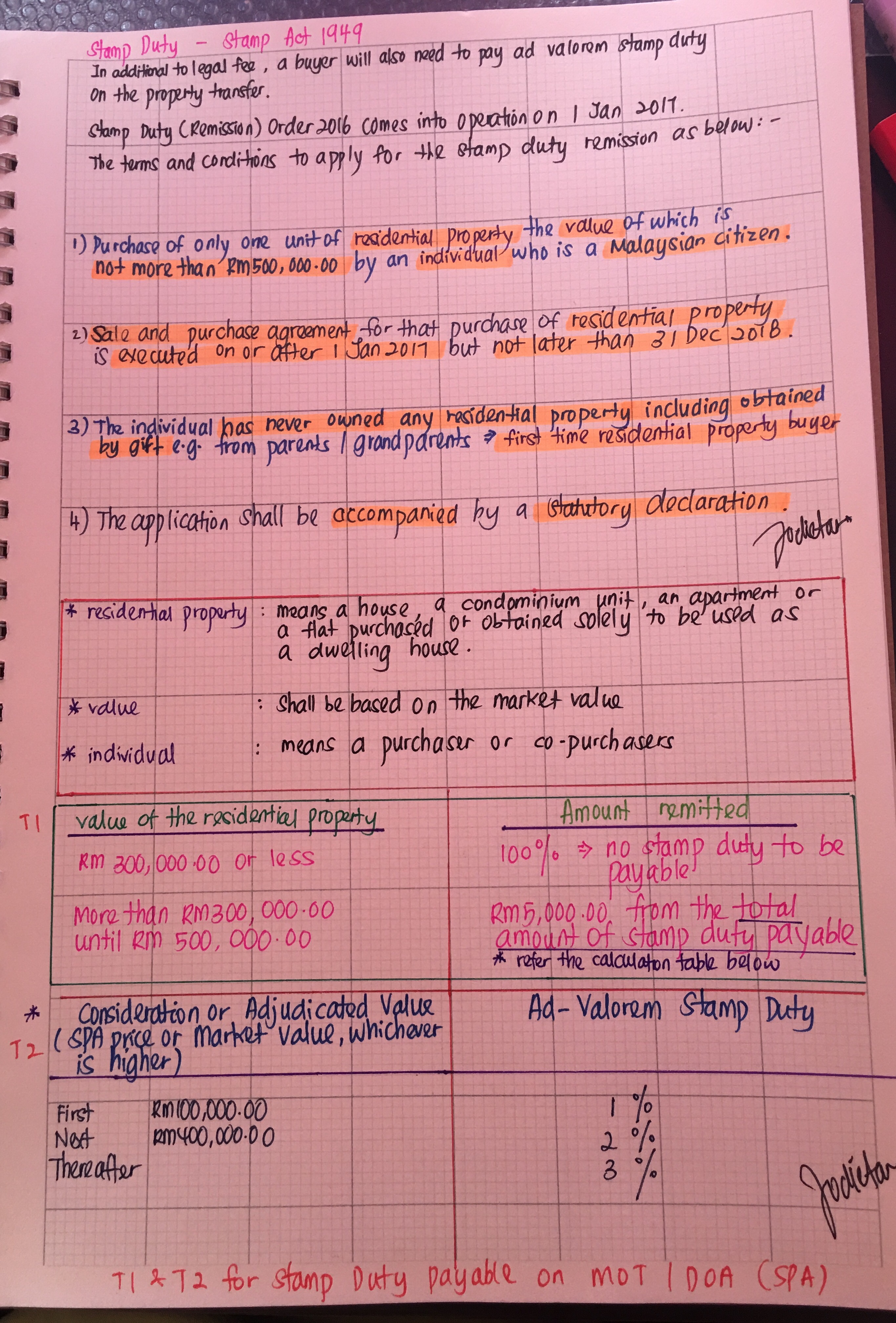

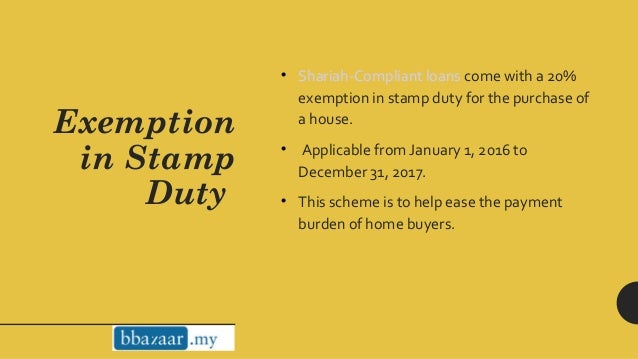

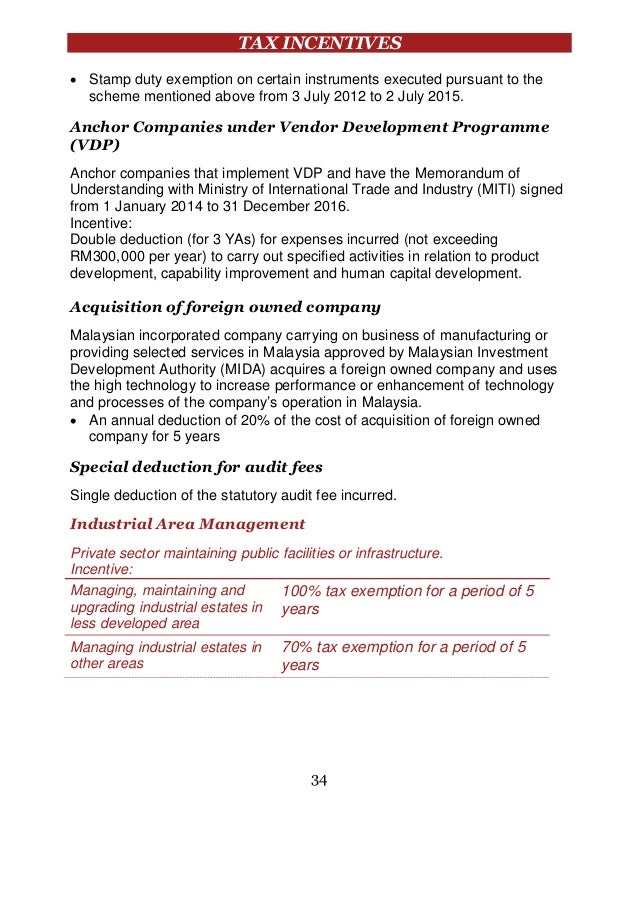

Stamp duty exemption malaysia 2016. In 2016 the stamp amendment bill 2016 stamp bill 2016 was introduced. Stamp duty relief if granted under certain circumstances. Stamp duty relief in the event that the transferee of the transferred asset is not a malaysian incorporated company. Kpmg in malaysia 2016 in addition to these allowances the ita allows among.

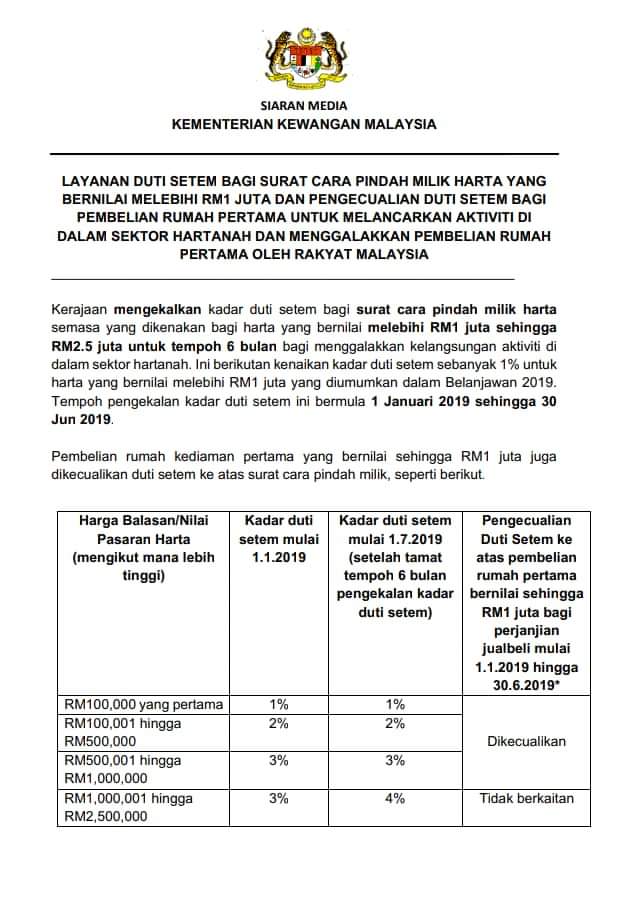

Hope this will clarify some issue regard to the stamp duty exemption 2019. A lot of goodies for first time house buyer and next year will be the best time to search and buy a house. Year 2016 stamp duty order remittance p u a 365 p u a 366 year 2020 stamp duty order exemption p u a 152 hit s. So you shall pay the difference rm2000 1500 rm500.

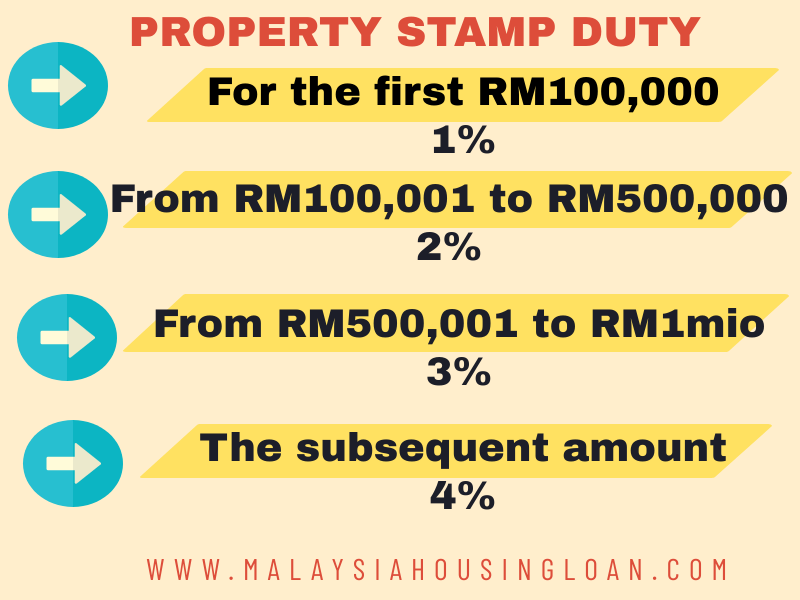

The maximum stamp duty exemption for loan agreement is rm1500. Payment of duty 65 exports 65 stamp duty 66 basis of taxation 66 rates of duty 66 stamping 67 penalty 67 relief exemption remission from stamp duty 68 other business information economic indicators and directions 71 economic growth 71 labour market 72 inflation 72 monetary policy 73 ringgit 73 financial reporting 74 employees provident. The stamp duty exemption is for the first rm300 000 property value stamp duty on the instrument of transfer. 2020 05 18 15 56 43 headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.

Stamp duty exemption malaysia 2020. The maximum stamp duty exemption for loan agreement is rm1500. C the transferee and transferor must remain associated for at least three. The transferee company is incorporated in malaysia.

Here are a list of federal gazette and surat akuan for the stamp duty exemption. Hi everyone this is an official media release from our finance minister on the stamp duty exemption 2019. The exemption applies for a maximum loan amount of rm300 000. Of ownership and to obtain approval to extend the tax duty exemption to the purchasing company.

Stamp duty malaysia 2020 budget 2019 was an exciting announcement and we think one of the biggest winners are under property and housing. Not only that the stamp duty exemption is also extended to the stamp duty on loan agreement too. The exception to the above is the transfer of shares in unquoted companies on bursa malaysia which will attract ad valorem stamp duty at the rate of 0 1. The transfer of shares attract stamp duty at the ad valorem stamp duty rate of 0 3 of the price or value of any shares on the date of transfer whichever is the greater.