Sports Development Act 1997 Tax Relief

Defination of sports under sports development act 1997.

Sports development act 1997 tax relief. Community development financial institutions chapter1 additionalempowermentzones. Interpretation p art ii sport development 3. A 177 2000 21 04 2000 p u. Continued application of tax on imported recycled halon 1211.

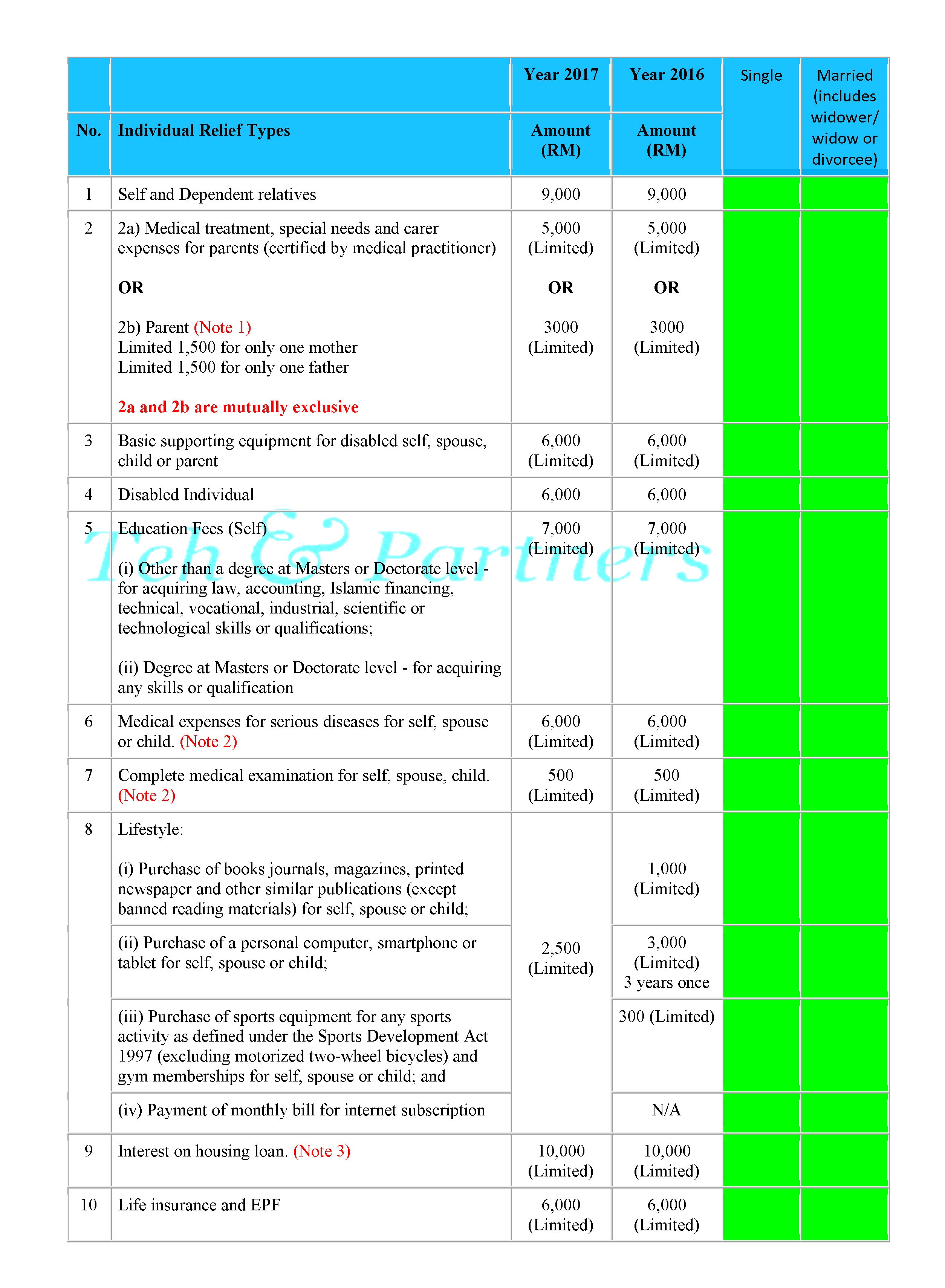

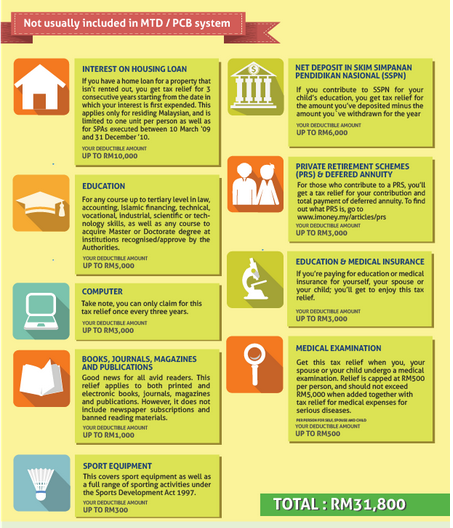

Guidelines in relation to sports development 4. The act included numerous targeted and broad based cuts estimated to produce 95 3 billion in tax relief over the five. Iii purchase of sports equipment for any sports activity as defined under the sports development act 1997 excluding motorized two wheel bicycles and gym memberships for self spouse or child. From the year 2008 individual taxpayers are allowed to claim tax deduction of up to rm300 a year on purchase of equipments for sports as defined by the sports development act 1997.

Tax relief up to a maximum of rm 300 a year be given on purchase of sports equipment. Short title application and commencement 2. 2014 public law 105 34 aug. A 170 1998 01 04 1998 first schedule p u.

As a general guideline the irb has taken the stand that consumables such as shuttlecorks golf balls etc. And iv payment of monthly bill for internet subscription. Uniform rate of tax on vaccines. Are claimable whereas those long lasting items such as sports shoes badminton rackets.

Billiards and snooker 8. Lhdn states in the income tax act that the tax relief for sports equipment is only eligible for those used in sporting activities defined in the sports development act 1997. A 279 2004 13 08 2004 dicetak oleh percetakan nasional malaysia berhad kuala lumpur. 787 enacted august 5 1997 reduced several federal taxes in the united states.

2 500 limited 9. The taxpayer relief act of 1997 was a comprehensive federal tax reform law. Other government ministries etc to consult with minister. Purchase of breastfeeding equipment.

This means equipment like footballs shuttlecocks nets rackets martial arts weapons fencing swords electronic scoreboards etc. Taxpayer relief act of 1997. The term equipment is not defined and is thus open to discussion. 5 1997 111 stat.

The taxpayer relief act of 1997 pub l. Starting in 1998 a 400 tax credit for each child under age 17 was introduced which was increased to 500 in 1999. This credit was phased out for high income families. Can be considered as sports equipment.

Act 576 sports development act 1997 list of sections amended section amending authority in force from 16 p u. And tax relief of up to myr 3 000 for the purchase of a computer to be claimable once over a three year period. The following activities are regarded as sports for the purposes of this act. Purchase of sports equipment for tax deductions.