Sole Proprietorship Taxes Malaysia

Sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26.

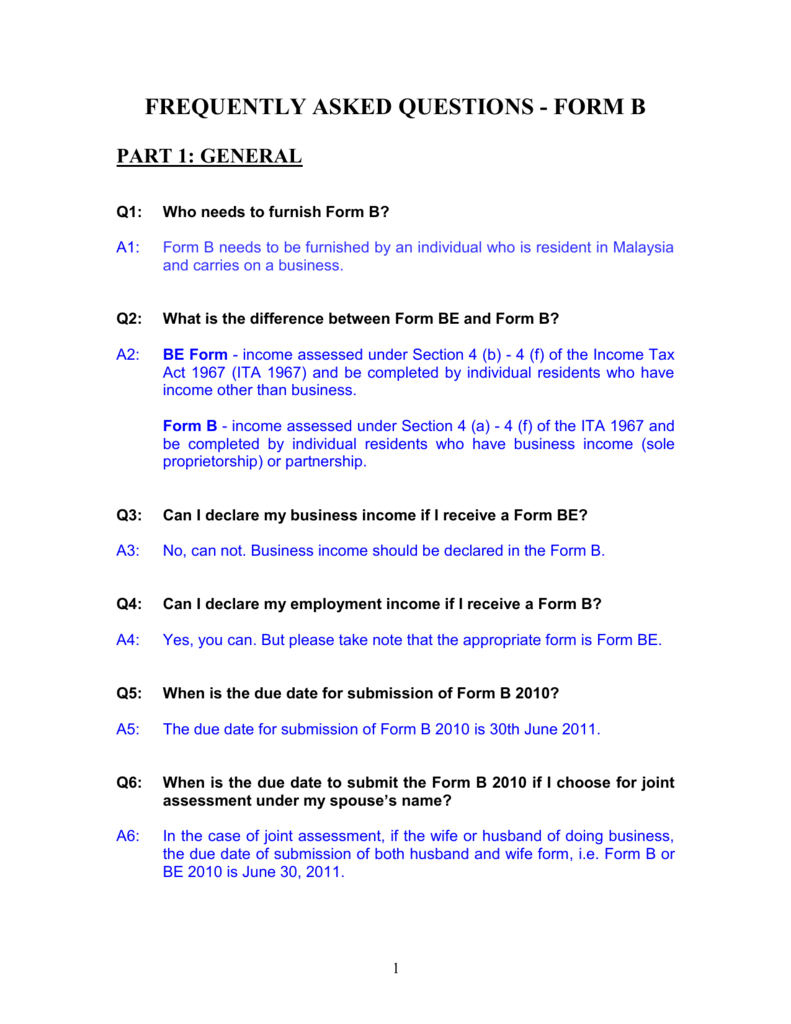

Sole proprietorship taxes malaysia. Find the definition of a sole proprietorship and the required forms for tax filing. This can reduce the paperwork required for annual tax filing. Corporate income tax in malaysia is applicable to both resident and non resident companies. Sole proprietorship are businesses in malaysia which are owned by just one individuals.

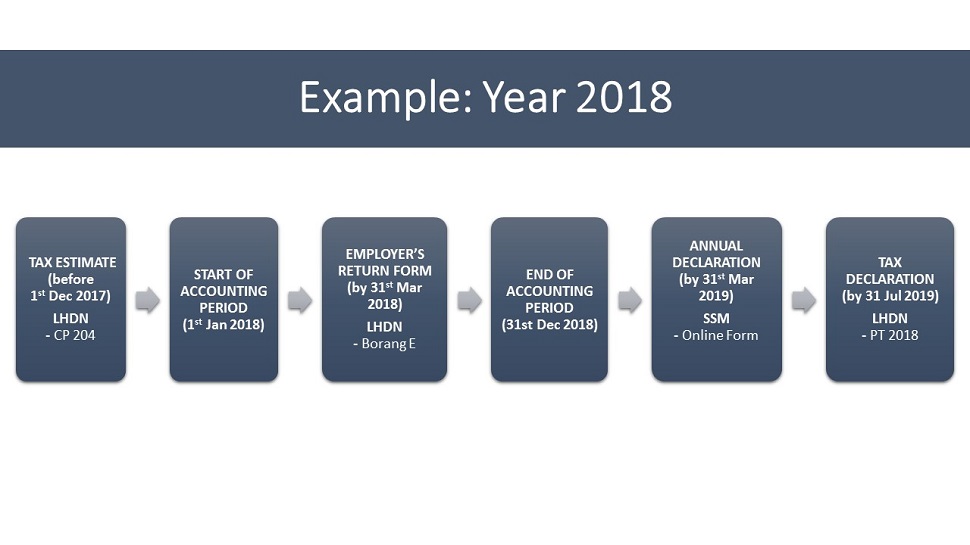

Precedent partner is also responsible for informing lhdnm officially if the partnership ceases changes to a sole proprietorship private limited company. But it s important to understand which sole proprietorship taxes you ll pay. Tax rate for sole proprietorship or partnerships. Lembaga hasil dalam negeri lhdn inland revenue board irb who you pay your taxes to and where you register for tax filing.

Nope you declare a lost in your business section of personal income tax if you made a loss. Unique features of a sole proprietorship like fast and easy registration no corporate tax payments less formal business requirements winding up easily and lowest annual maintenance compare to other business vehicle such as private limited company sdn. Owners of sole proprietorship experience unlimited liability which means that if the business fails to survive or declares bankruptcy creditors will be able to sue the business owners for all the debts which are owed. Btw when referring to http mygov malaysia gov my en relevant 2 rietorship aspx under sole proprietorship it says you only need to pay personal income tax and not business tax does any1 know does it mean sole proprietor don t need pay extra tax as with partnership enterprise limited pte limited.

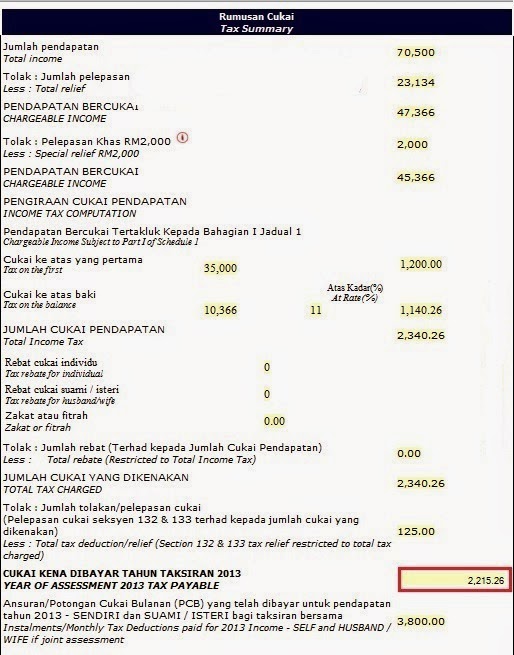

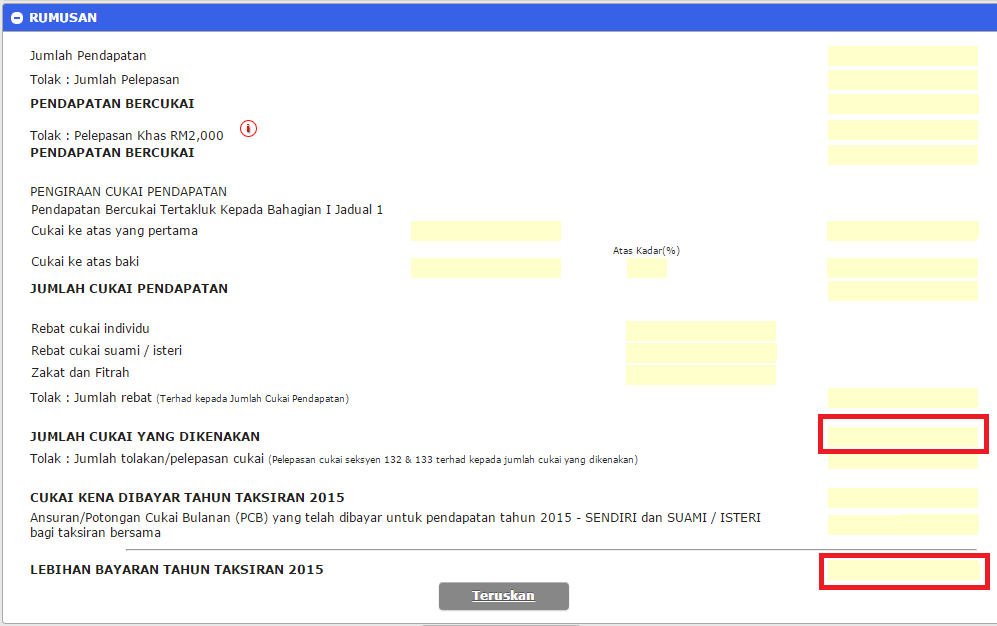

To check and sign duly completed income tax return form. For tax purposes a sole proprietorship is a pass through entity. To compute their tax payable. Business income passes through to the business owner who reports it on their personal income tax return.

A sole proprietor is a self employed individual and must pay self employment taxes social security medicare tax based on the income of the business. Bhd or limited liability partnership. Self employment tax is included in form 1040 for federal taxes calculated using schedule se and the total self employment tax liability is included on line 57 of form 1040. A sole proprietor is someone who owns an unincorporated business by himself or herself.

Husband and wife have to fill separate income tax return forms. Other taxes paid by a sole proprietorship comprise of self employment taxes social security taxes and property taxes. However if you are the sole member of a domestic limited liability company llc you are not a sole proprietor if you elect to treat the llc as a corporation.

%202.png)