Sole Proprietorship Malaysia Income Tax

Business code guideline can be obtained.

Sole proprietorship malaysia income tax. Remember llps are separate entities from their partners. Btw when referring to http mygov malaysia gov my en relevant 2 rietorship aspx under sole proprietorship it says you only need to pay personal income tax and not business tax does any1 know does it mean sole proprietor don t need pay extra tax as with partnership enterprise limited pte limited. Other taxes paid by a sole proprietorship comprise of self employment taxes social security taxes and property taxes. Go to a ssm branch near to you get the forms fill it up there are examples there on how to fill it up and get a number.

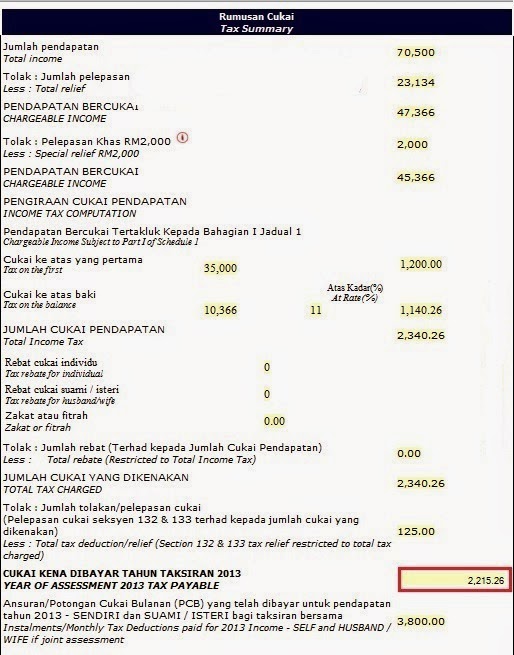

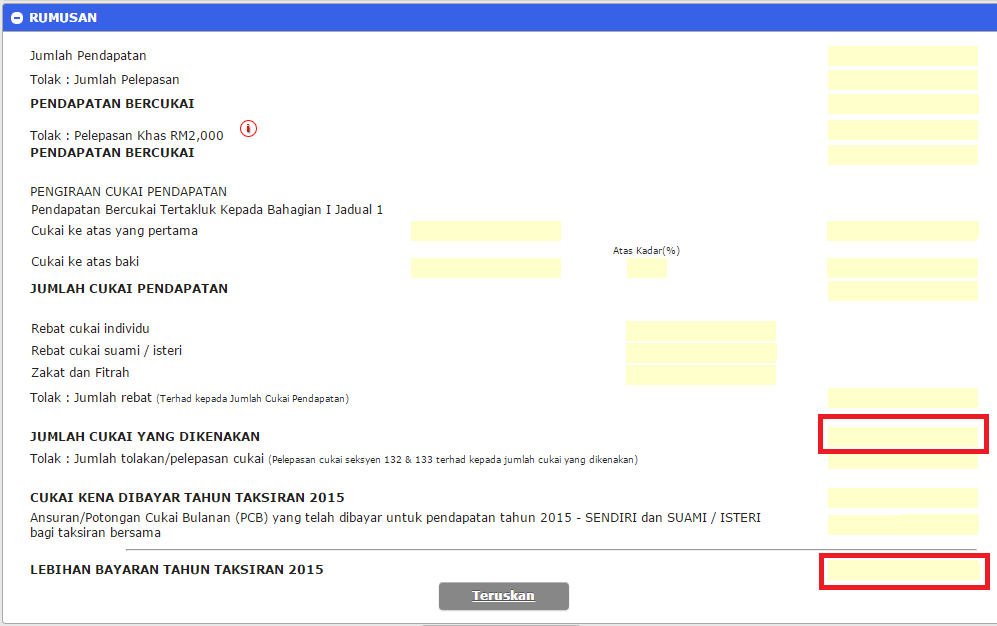

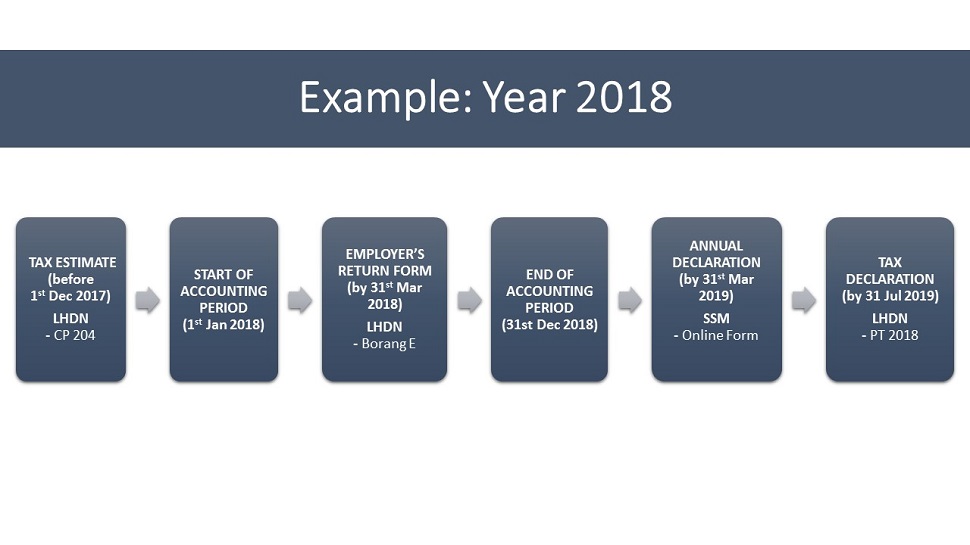

Husband and wife have to fill separate income tax return forms. If you ve been earning but not declaring your income for tax purposes there are sections to self declare your earnings from previous years. Teri is a sole proprietor single tax filer. Sole proprietorship private limited company deadline for submission of form b p and payment of tax payable if any.

By virtue of the sole proprietors and partners drawing salaries and allowances for themselves are they require to contribute the employer s 12 contribution and deduct 11 from the salaries and allowances and remit this 23 12 11 contributions to epf. Nope you declare a lost in your business section of personal income tax if you made a loss. Let s see the definitions of employer and employee under the epf rules. Corporate income tax in malaysia is applicable to both resident and non resident companies.

Your tax rate will depend on your income from 0 28. Precedent partner is also responsible for informing lhdnm officially if the partnership ceases changes to a sole proprietorship private limited company. To check and sign duly completed income tax return form. For your personal income tax remember that you still need to submit form e be online.

She must pay self employment tax of 15 3 on this income or 1 530. She completes her schedule c which shows her net business income as 10 000. She gets a deduction of half this amount so she must pay 765 for this tax. Form b that s for if you re a sole proprietor or form p that s for a partner in a conventional partnership.

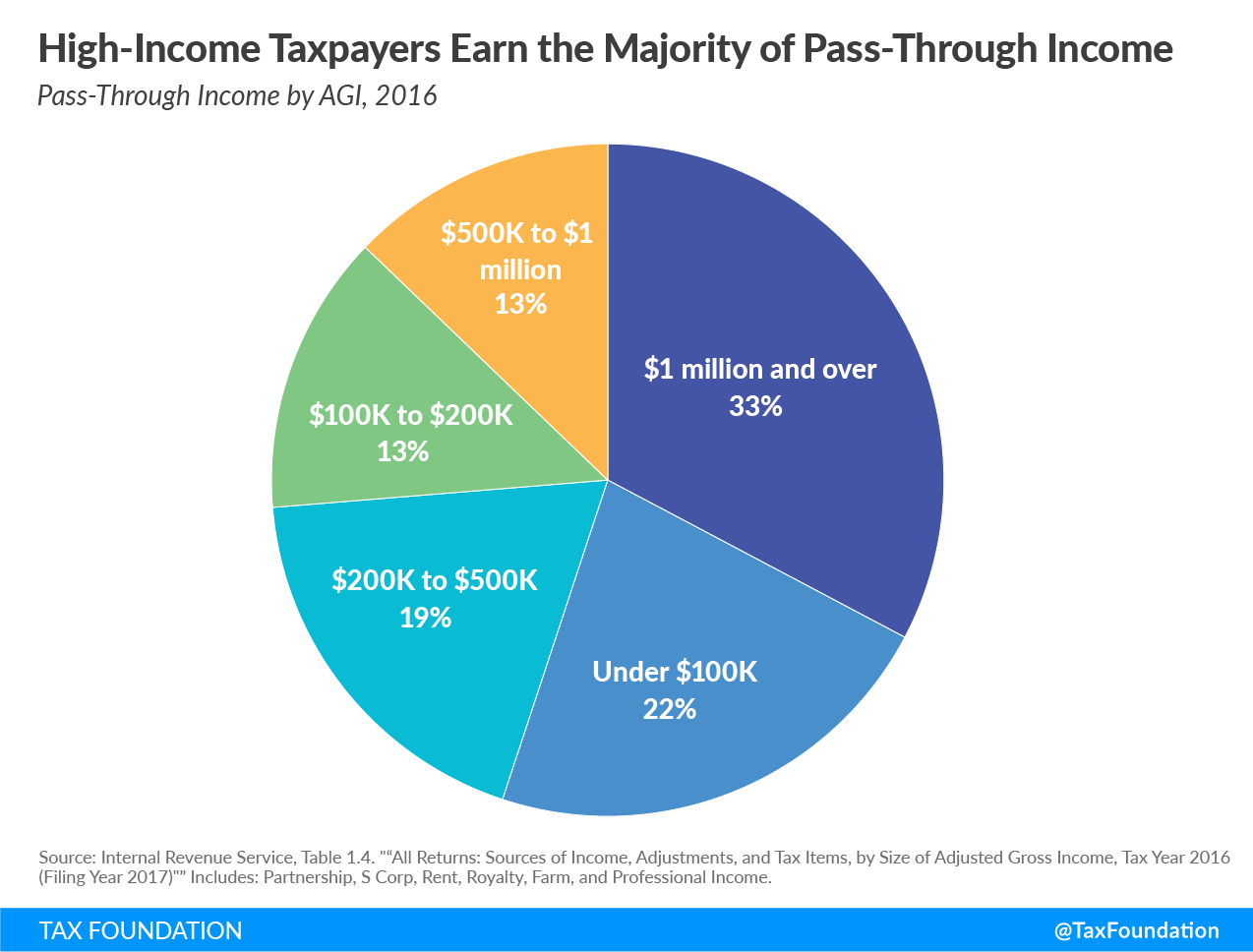

Companies are taxed at the 24 with effect from year of assessment 2016 while small scale companies with paid up capital not exceeding rm2 5 million are taxed as follows. This is her taxable business income. 30 june every year refer to account s statement supporting documents other income statement and receipts fill in the correct business code when filling the income tax return form itrf. For many small scale online businesses in malaysia sole proprietorship single owner or partnership more than one owner is enough and the cheapest option.

Sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26.

.png)

/GettyImages-539358257-5a7cd1c2eb97de0037c6f4e1.jpg)