Sole Proprietorship Income Tax Calculator Malaysia

But it s important to understand which sole proprietorship taxes you.

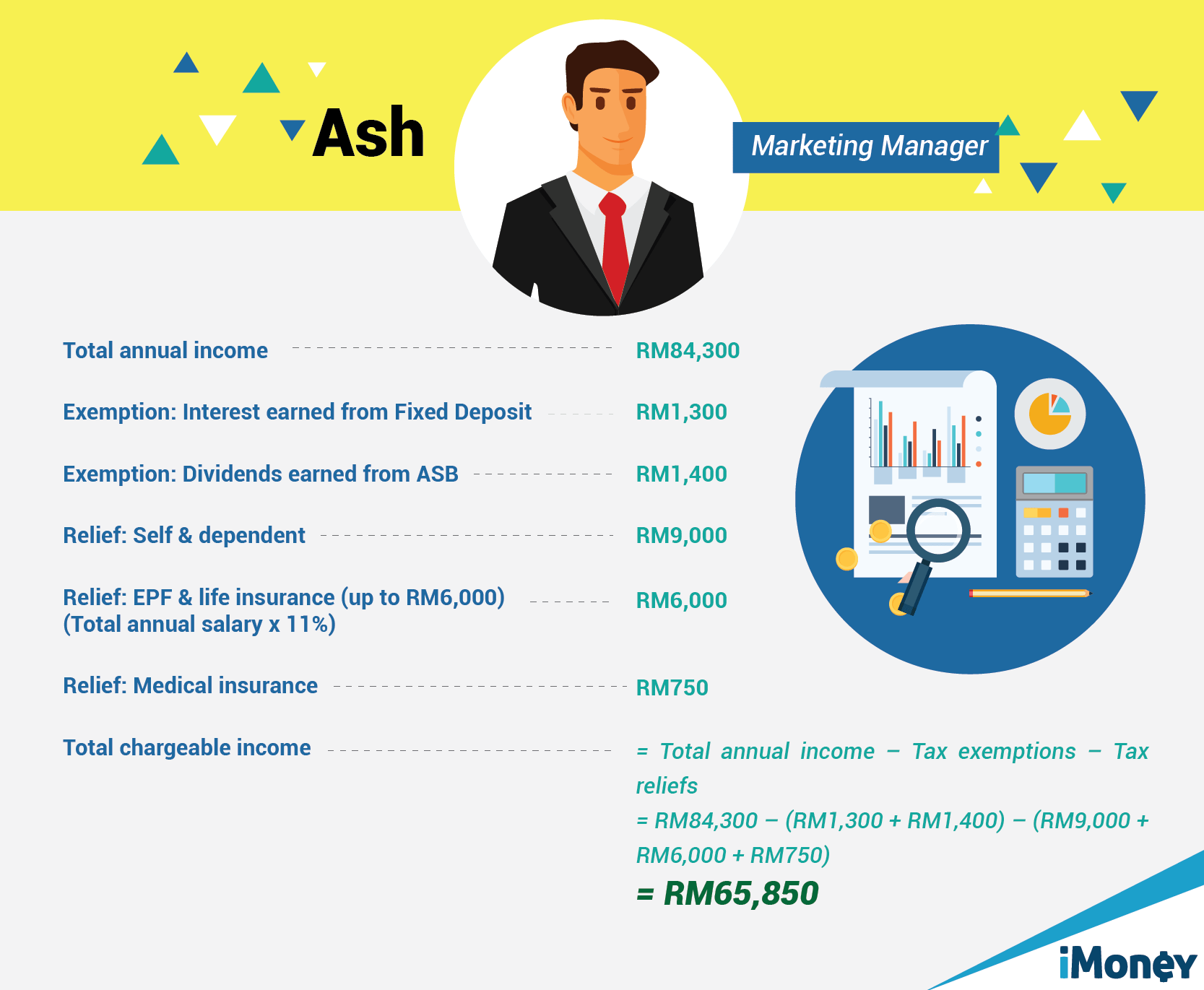

Sole proprietorship income tax calculator malaysia. The second most important part is knowing which tax reliefs apply to you. Keep in mind you may be able to offset this income if you have qualifying expenses. If you have received full time or part time income from trade business vocation or profession you are considered a self employed person. This can reduce the paperwork required for annual tax filing.

Corporate income tax in malaysia is applicable to both resident and non resident companies. Income tax facts in malaysia you should know. Especially as new reliefs are included while old ones get removed every year. To check and sign duly completed income tax return form.

You have to report this income in your tax return. Sole proprietorship taxes defined. This page shows the relevant information to help you prepare and file your tax return. Companies are taxed at the 24 with effect from year of assessment 2016 while small scale companies with paid up capital not exceeding rm2 5 million are taxed as follows.

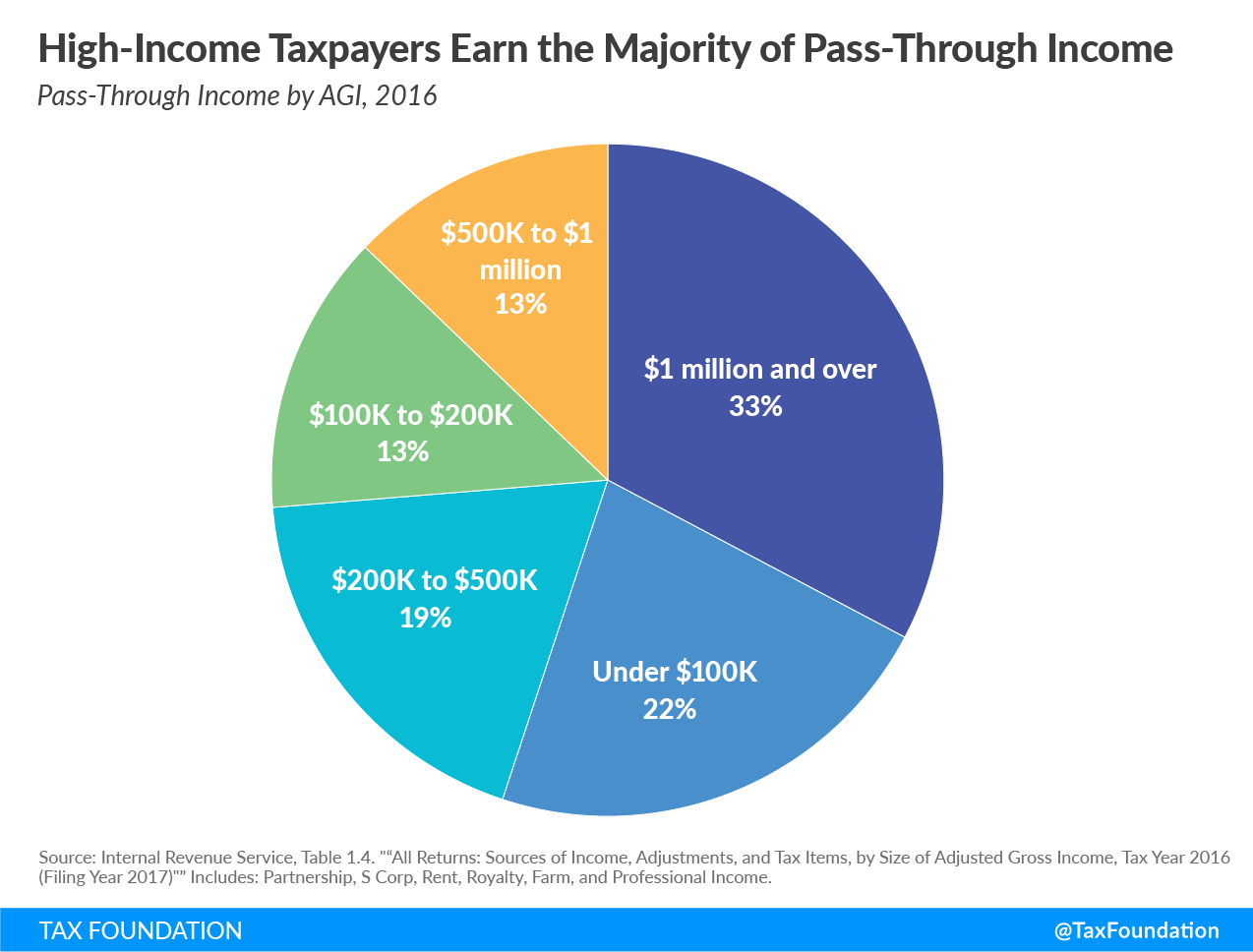

Sole proprietor taxes compared to the personal income tax. If you 1 are self employed as a sole proprietorship an independent contractor or freelancer and 2 earn 400 or more you may need to pay se tax. For tax purposes a sole proprietorship is a pass through entity. The calculator allows you to compare the taxes paid by an sole proprietor in the simplified taxation system and the individual.

As a sole proprietorship you can claim 50 of self employment tax costs as income tax deductions. Precedent partner is also responsible for informing lhdnm officially if the partnership ceases changes to a sole proprietorship private limited company. This is true even if you are paid in cash and do not receive a 1099 misc. Other taxes paid by a sole proprietorship comprise of self employment taxes social security taxes and property taxes.

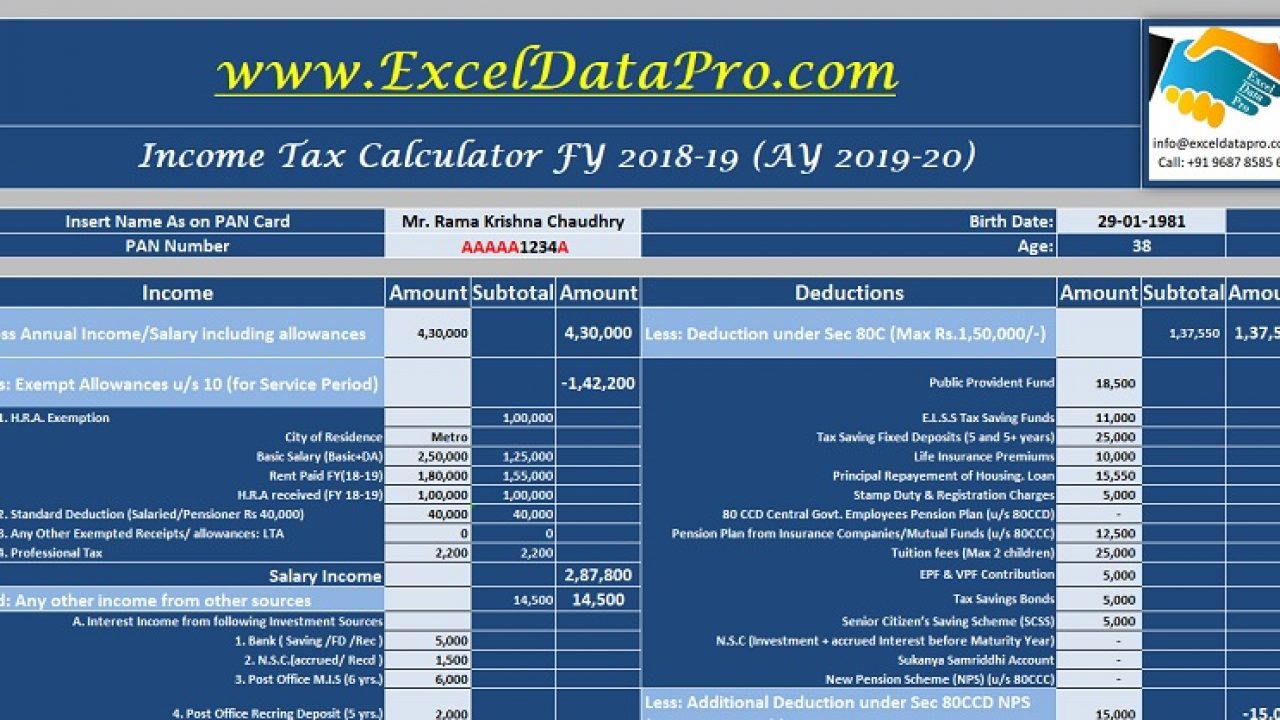

To compute their tax payable. Additionally social security contributions max out when your income reaches 127 200 note. Sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26. The most important part of income tax is knowing how much you owe the inland revenue board.

Business income passes through to the business owner who reports it on their personal income tax return. The tax rate for sole proprietorship or partnership will follow the tax rate of.

.png)