Socso Invalidity Pension Scheme

You are entitled to a free travel pass.

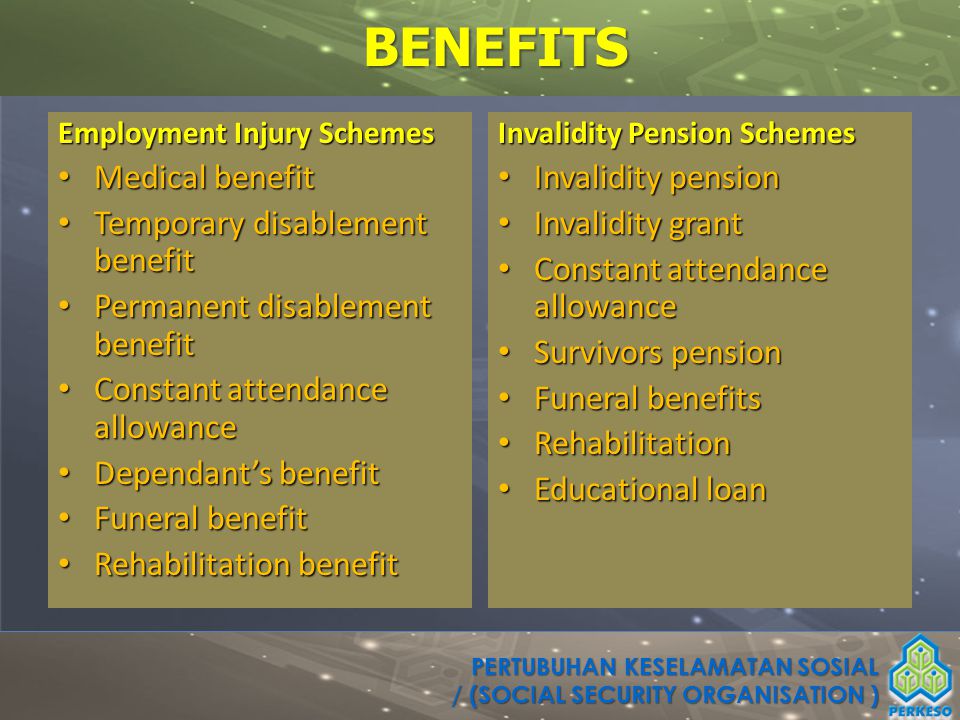

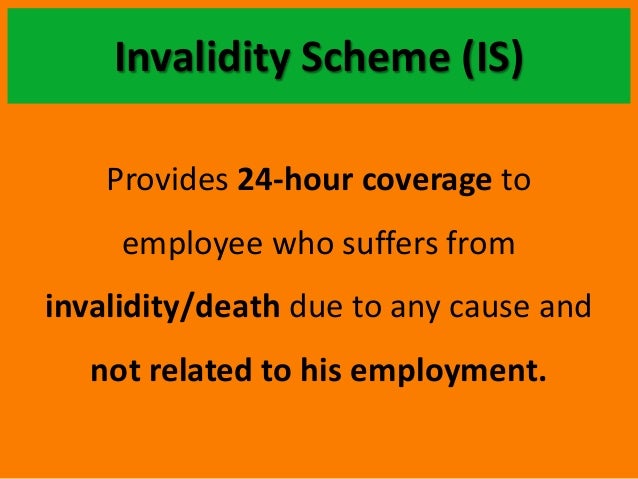

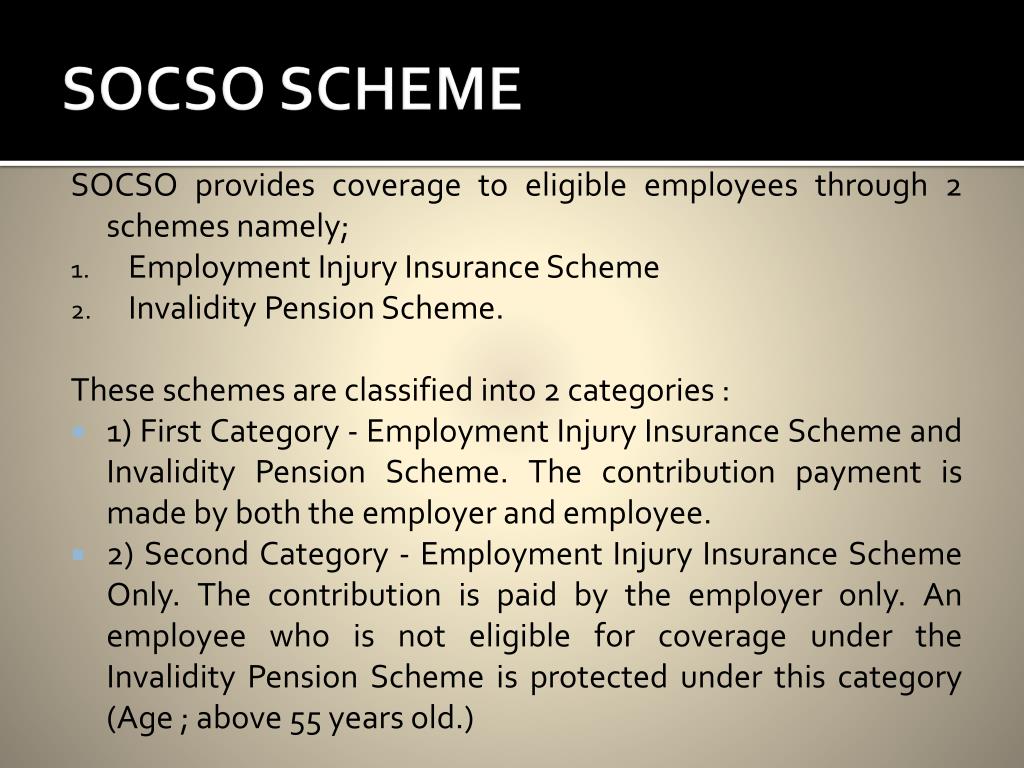

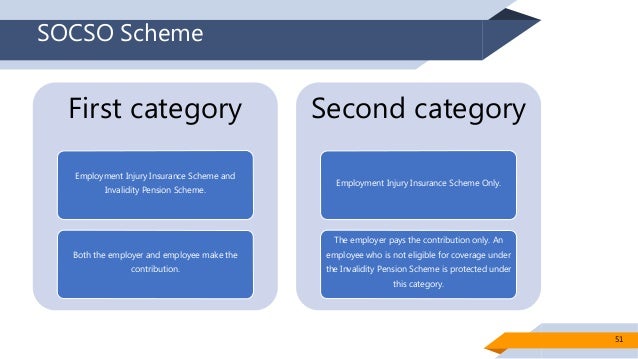

Socso invalidity pension scheme. Employees in the statutory bodies who joined service before 15 january 1975 and who had opted for either the epf scheme or the pension scheme are eligible for benefits under the socso act 1969 however employees. The social security organisation of malaysia socso is the main public institution governing the provision and management of the employment injury insurance eii and invalidity pension ip schemes. At 66 you transfer automatically to the state pension contributory at the full rate. The scheme provides 24 hour coverage to employee who suffers from invalidity or death due to any cause and not related to his employment.

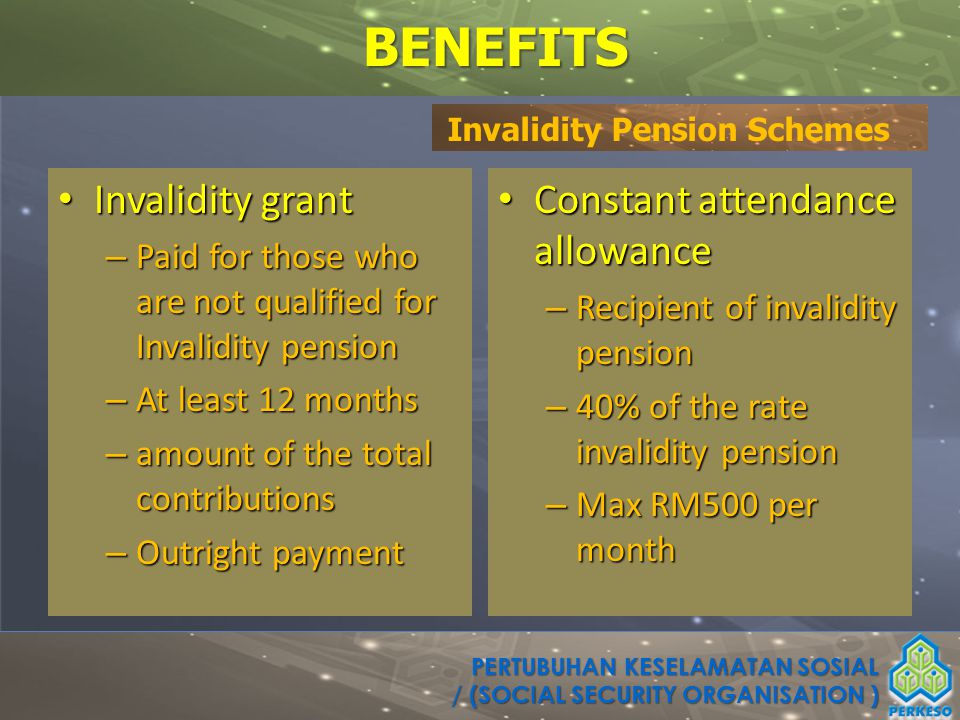

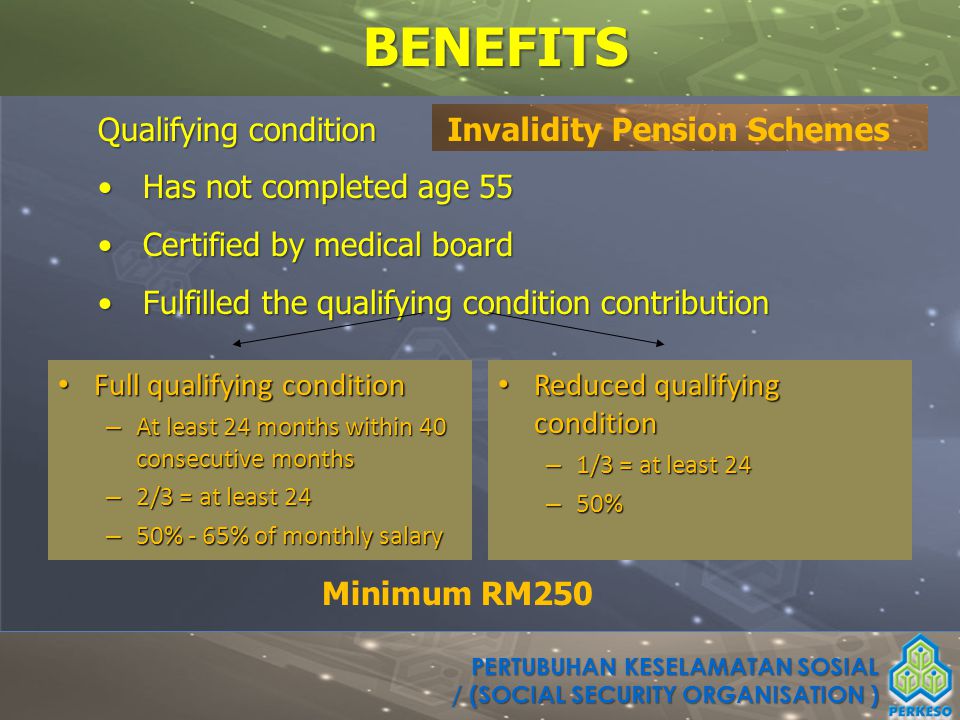

Invalidity pension scheme provides a 24 hours coverage to employees against invalidity and death due to any cause not connected with employment before the age of 55 years. Invalidity pension scheme invalidity is defined as a serious disablement or morbid condition of a permanent nature that is either incurable or not likely to be cured as a result of which an employee is unable to earn at least 1 3 of what a normal able person could earn. An insured person shall be considered as suffering from invalidity by reason of specific morbid condition of permanent nature either incurable or is not likely to be cured and no longer capable of earning by work corresponding to his strength and physical ability at least 1 3 of the customary earnings of a sound insured person. The rate of invalidity pension for full qualifying period is from 50 to 65 of the average assumed monthly wage subject to a minimum pension of rm475 per month.

Invalidity pension is a weekly payment to people who cannot work because of a long term illness or disability and are covered by social insurance prsi. The employment injury scheme and the invalidity scheme under act 4 allow socso to provide free medical treatment facility for physical or vocational rehabilitation and financial assistance to employees if the accidents or diseases have reduced their abilities to work or rendered them incapacitated. The insured persons are entitled to receive a pension at the rate of 50 of the average assumed monthly wage increase by 1 for every 12 months contributions that are paid in excess. Once you reach the age of 66 you transfer automatically to the state pension contributory at the full rate.

Invalidity pension is taxable.