Socso Contribution Rate 2019

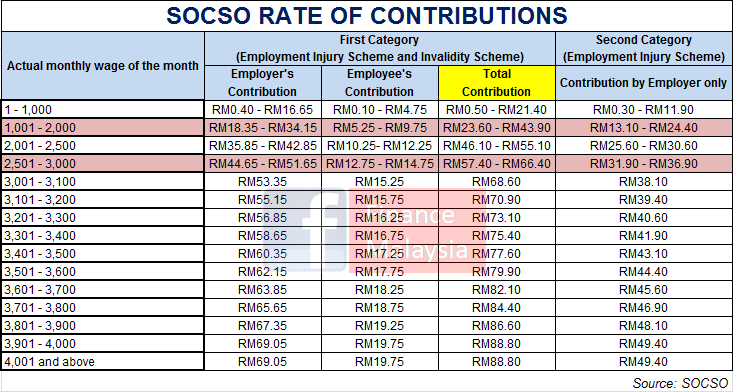

Rate of contribution monthly contribution is subject to the ceiling of the insured wage of rm4 000 00 per month.

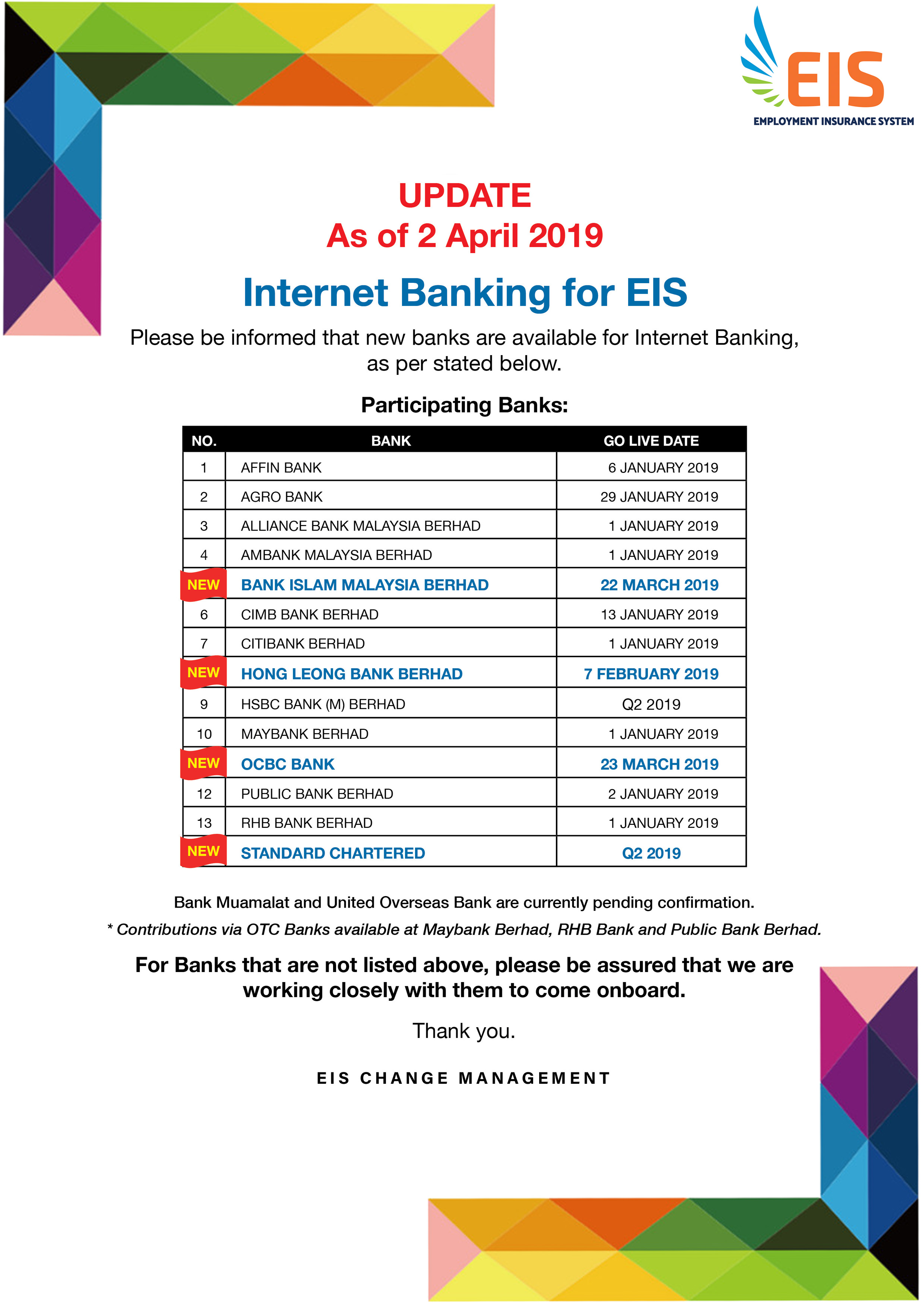

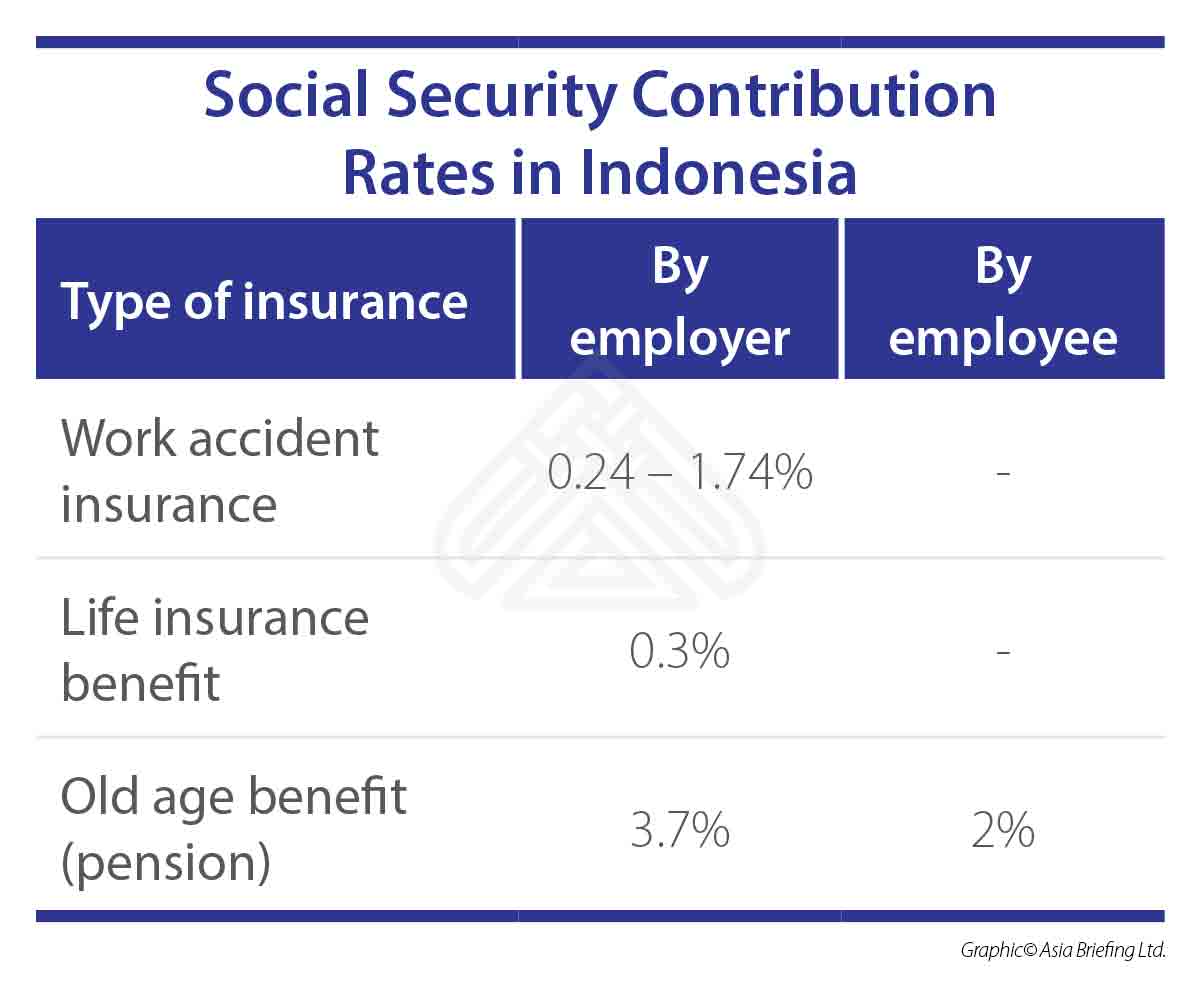

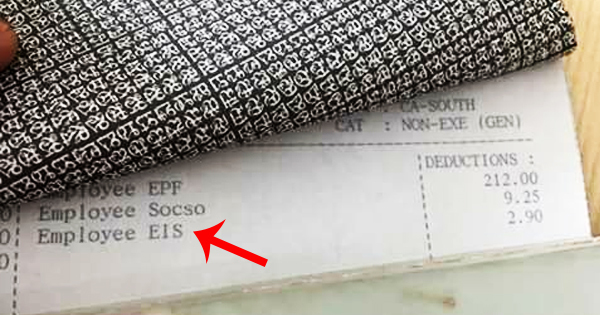

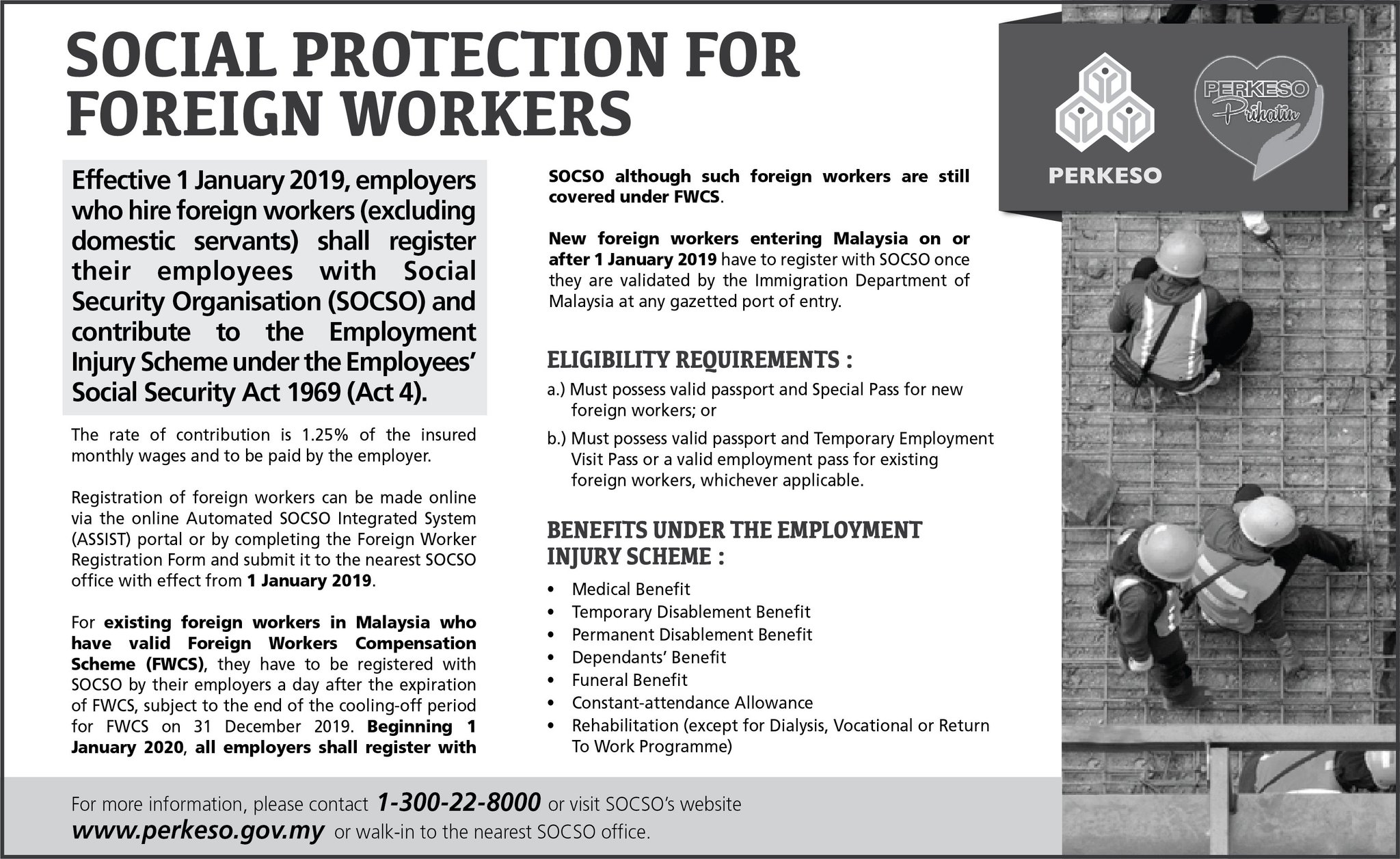

Socso contribution rate 2019. Contributions to the employment insurance system eis socso table 2019 are set at 0 4 of the employee s assumed monthly salary. Read latest posts or hide this alert. 0 2 will be paid by the employer while 0 2 will be deducted from the employee s monthly salary. The company will pay 1 75 while the staff workers will contribute 0 5 of their wages for the employment injury insurance scheme and the invalidity pension scheme.

In simple terms there are two categories of the socso fund. Then the total amount is the addition of these two and will go towards the socso fund. I c your complaint send to 15888. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13.

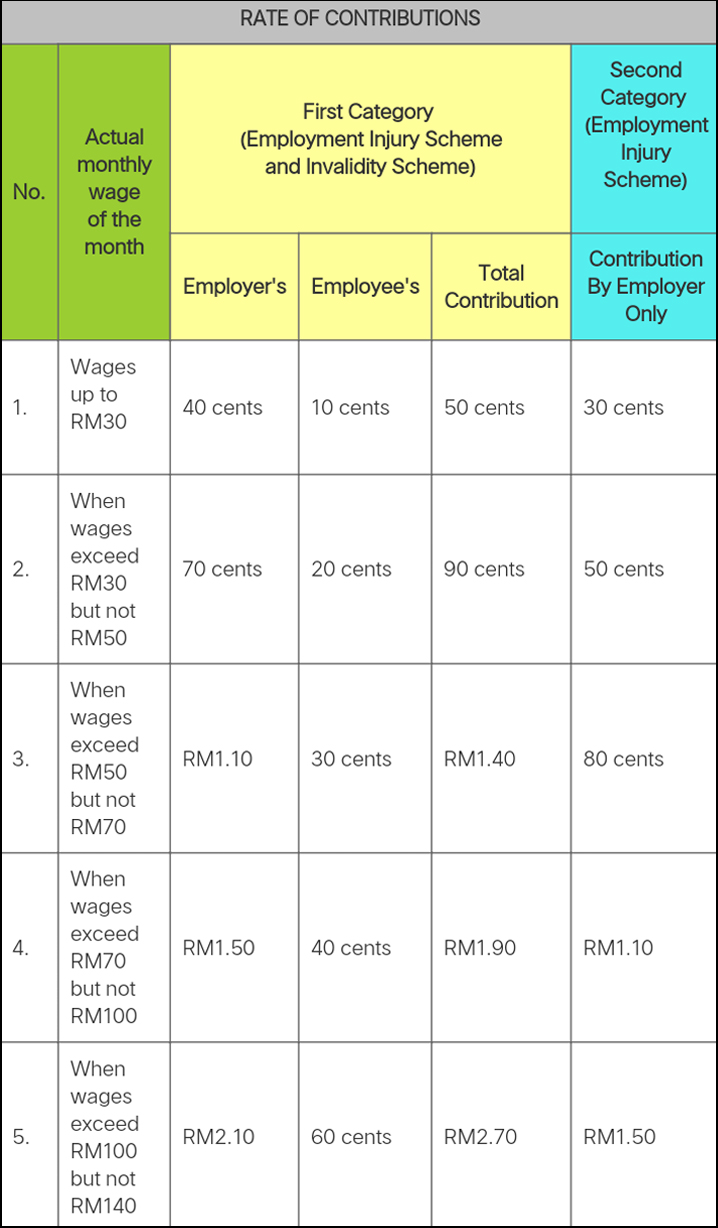

03 4256 7798 sms. I c your complaint send to 15888. 03 4256 7798 sms. Wages up to rm30.

A company is required to contribute socso for its staff workers according to the socso contribution table rates as determined by the act. Menara perkeso 281 jalan ampang 50538 kuala lumpur. In the first category for the most part the employer is to pay 1 75 of the employee s total salary towards the fund and the employee is to pay 0 5 of their salary amount towards the fund. Share on track this topic print this topic.

For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. Contribution table rates jadual caruman socso s employment insurance system. Forum announcement new registrations disabled until further notice. Menara perkeso 281 jalan ampang 50538 kuala lumpur.